The story of Clarivate over the past five years has been a tale of two companies. On the one hand, it has substantially strengthened its product offerings through a set of major acquisitions. For higher education, it strengthened its holdings through the acquisition of ProQuest and its important portfolio of platforms and products for the academic library. But on the other hand, Clarivate has been a continuing story of leadership instability. Clarivate was taken public by Jerre Stead, and under his leadership focused on major acquisitions and financial positioning, rather than product strategy. His rupture with Annette Thomas served for some as a perfect illustration of his disconnect with the community. Now, though, we are heading into a new chapter. Andy Snyder, who led ProQuest’s growth before selling it to Clarivate, serves as Clarivate board chair. Relatively new CEO Jonathan Gear seems to have diagnosed some of the company’s challenges, particularly that the road to long-term sustainable financial success runs through product leadership, and the company appears prepared to invest to address them. Today, in a move that will affect the scholarly publishing and higher education sector directly, Clarivate has announced that it has installed Bar Veinstein, an old Ex Libris hand, as president for Academic & Government (A&G).

I got to know Veinstein when he was president of Ex Libris — after it was acquired by ProQuest, before ProQuest was acquired by Clarivate. At that time, he was green-lighting new enterprise software initiatives (for example, the development of the Esploro research information management service and the acquisition of RapidILL) that leveraged Alma’s commanding lead in the library systems platform market.

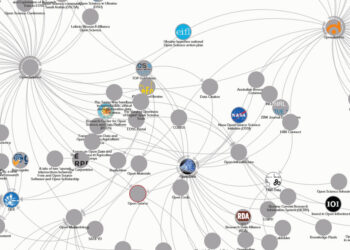

Today, the Clarivate A&G business for which Veinstein takes responsibility includes not only Ex Libris but also two other important sets of properties, the ProQuest content businesses and the Web of Science research enterprise businesses. Finally — after Stead’s unsuccessful effort to combine the largely unrelated intellectual property, life sciences, and A&G businesses under a single “chief product officer” — there is a clear leadership structure for A&G. The task before Veinstein today is clear: rationalize the A&G unit and drive product innovation.

This will be no small effort. The product strategy logic of the ProQuest acquisition is in one sense not hard to articulate. There are two premier products, Web of Science (including JIF, the Journal Impact Factor) and Alma, each of which holds a commanding market share. It should be possible to develop and market a variety of adjacent products on the foundation that these two provide. Sad to say that, while many existing products continue to perform well, Clarivate has yet to deliver on this promise.

Indeed, it has barely kept up. Clarivate has been coasting on its Web of Science businesses for a long time (by many reports, since before there even was a Clarivate). To be sure, just this past year, Web of Science has introduced new indices, for example for preprints, is modernizing its rankings, and has developed new capabilities to police the scholarly record. But, as a product, CEO Gear rightly describes it as “dusty,” a situation brought on by a lack of investment and therefore an “own goal.” The landscape is rife with competitors, both commercial and otherwise.

In some ways, though, the lack of investment in Alma may prove to be an even more serious risk. By late 2019, Alma had secured the dominant position in the academic sector, a lead that was particularly commanding among the largest (and most lucrative) research libraries. But, having done so, it has been coasting. It has neither innovated sufficiently to secure its position against competitors nipping at its heels nor has it introduced a stripped-down lower-priced version to expand into other parts of the market. In the fall, the Library of Congress announced it would adopt the EBSCO-supported FOLIO system and contribute to its open source stack to ensure it can meet the needs of the largest research library in the world. In recent weeks, we have seen several announcements about academic libraries moving away from Alma and to FOLIO, including the 26 Georgia public universities. In one such announcement, a dean of libraries mentioned that “This move will result in significant savings.” We can expect to see Alma continue to lose ground to FOLIO for the foreseeable future.

To be fair, there may be product innovation at Clarivate that due to timing has yet to be announced. What is clear, is that Veinstein and team will need to accelerate the pace not only of production innovation but also of moving innovation to market.

In terms of acquisitions, Clarivate has been largely frozen, perhaps a consequence of the collapse of its stock price almost two years ago. It missed out on Interfolio, the biggest asset to come to market, which Elsevier snapped up. While Gear has promised to invest to compete, it is unclear whether Clarivate will bring to bear the capital necessary to compete with Elsevier (and some upstarts as well) in the A&G sector in the years to come.

On the other side of the ledger, Clarivate has yet to dispose of any assets following the ProQuest acquisition, where the product strategy clearly needs to be rethought amid an evolving marketplace. For example, the publisher services businesses have changed dramatically in recent years, with Elsevier and Wiley having built up impressive portfolios alongside the organic growth of independent players like SilverChair and Morressier. Will we see a strategy to build upon ScholarOne or will it make more sense for it to change hands?

Finally, there is a question of talent. It is not uncommon to have some turnover during an acquisition, but the Clarivate acquisition of ProQuest was notable for the departure of key leaders. In that period, an enormous braintrust of executive, strategic, and product leadership departed, including many of the leading minds behind Ex Libris — Veinstein included. While it seems unlikely that Snyder and Veinstein will “get the band back together,” it will be worth following their progress on talent recapitalization particularly in support of solutions-minded product innovation. At the same time, it will be important not to lose any more talent than necessary in this moment of transition.

Snyder and Gear appear to have diagnosed the problem and are moving towards addressing it by restructuring and installing new leadership in Veinstein. Time will tell if they can position the A&G businesses for innovation and growth in a complex and fast-changing marketplace.

Discussion

3 Thoughts on "Will New Clarivate Leadership Yield a Renewed Focus on Its Products?"

Clarivate has been coasting on its Web of Science businesses for a long time

I don’t think this can be understated. Rolling out a new interface or introducing new ways to graph citations are simply store-front dressing that cannot paper over a chronic inability to timely index the journal literature. We are in the middle of April and all of my clients are still complaining that have 2022 content that remains unindexed. At a time when most of the indexing work is now done by the publisher, who simply drop their metadata into an FTP folder with the company, it tells me that the WoS simply lacks the critical infrastructure and people necessary to do basic processing.

As a result, I’d be surprised the JCR is released in June and whether the community will consider the findings to be accurate and reliable. As a discovery index, the WoS may be bleeding users to other platforms that do a better and faster job indexing the literature. And, it makes derivative products that are based on WoS data much less valuable.

If the Web of Science is considered core to their business model, they need to do much more than wipe off a little “dust.”

I completely agree. Especially with the change to article dating and the effect on Impact Factor, late indexing can have serious consequences to both authors and journals.

Many libraries on the ALMA-L listserv are reporting that Ex Libris support staff have taken up the habit of closing support tickets without resolving them: “After thorough examination and prioritization, we have decided that a fix for this issue will not be part of our current development work plan.” In many cases, these are not suggestions for development, but requests for troubleshooting or bug fixes. Support for Alma was already mediocre, but this is a whole new level. Clarivate cannot expect to remain an ILS heavyweight if their model is to provide poor customer service for buggy, bloated, poorly-tested software.