2017 was not a good financial year for the Public Library of Science (PLOS).

PLOS’ most recent 2017 financial overview, released on 12 December 2018, depicts an organization trying to reinvent itself, focusing less on disruption and innovation and more on efficiency and collaboration.

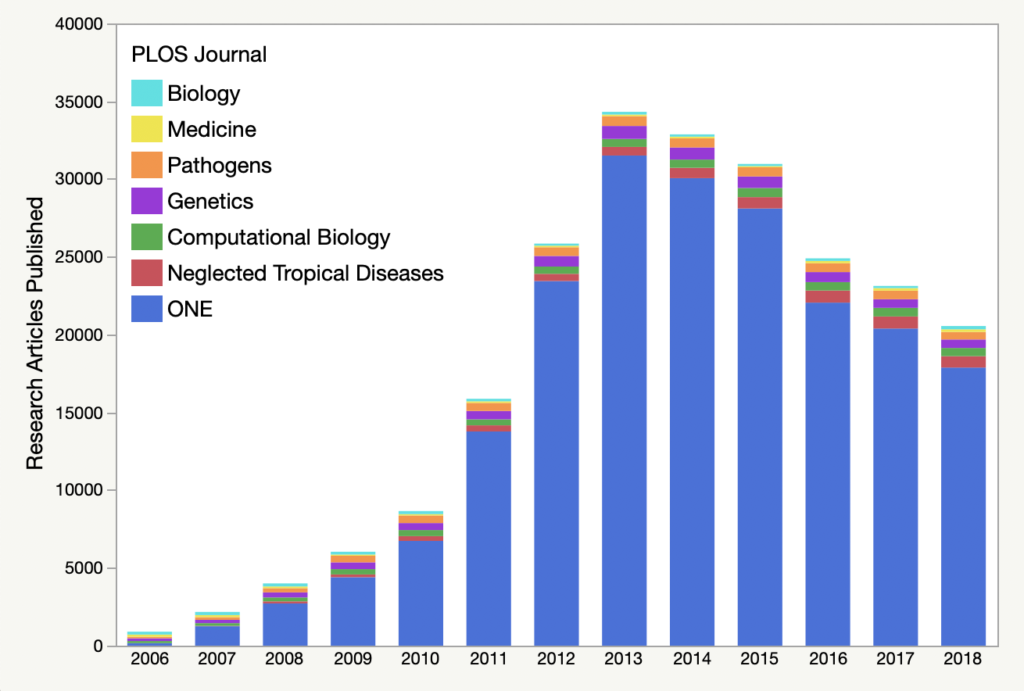

Revenue at PLOS was down by nearly US $2 Million in 2017, largely the result of declines in submissions to PLOS ONE, its largest journal, according to the report.

More importantly, PLOS wrote off US $11.1M in expenses in building Aperta — a manuscript submission system that the publisher ultimately decided to abandon after years of development.

Total salaries and employee compensation were also up by 2% in 2017 despite publishing 7% fewer papers.

Elizabeth Marincola, the former CEO, whose abrupt departure from PLOS was announced by tweet, received $363K in compensation in 2017 but left her position in 2016. Her exit came barely three-years after the abrupt departure of PLOS’ previous CEO and CFO. Marincola was replaced by Alison Mudditt in June 2017, who was paid $203K for six-months of service. (Disclosure: Mudditt is a current blogger at The Scholarly Kitchen).

The net effect of reduced revenue, increased personnel costs, and developing software that it never fully implemented, required PLOS to dig deep into its savings, reducing its net assets by nearly one-half (from $29.8 M in 2016 to $17.0 M in 2017). PLOS still has a lot of money in the bank, just a lot less of it. Given that publication output was down again by 11% in 2018, we are likely to see another poor balance sheet next fall.

PLOS is not a financially diversified company. It is almost entirely dependent upon a single revenue model (the article processing charge) from a single journal (PLOS ONE). This makes the publisher highly vulnerable to market changes and competition with larger, more diversified publishers, like Springer Nature, which publishes Scientific Reports. In 2017, Scientific Reports overtook PLOS ONE as the largest scientific journal.

PLOS’ 2017 Financial Overview is a humbling read. Grand aspirational goals to disrupt and reinvent scholarly publishing are replaced with promises to work with others in collaboration and to seek greater efficiency within their organization. In a short few years, the tone in its reports has shifted from exuberance to existential dread:

“All our decisions in 2017 (and 2018) have been driven by the need to be fiscally responsible and remain a sustainable non-profit organization.”

While PLOS’ piggy bank is still half-full, it may be difficult in a time of financial retrenchment to convince its board and stake-holders that it desperately needs to take on new challenges in the coming years or risk becoming a much diminished and marginalized publisher.

Discussion

16 Thoughts on "Poor Financials Pushes PLOS To Ponder Future Prospects"

I’m think PLOS will find its way. To help support PLOS and the value they provide to the scholarly community, my library at Iowa State has established an institutional account with them and will be fully covering our author’s APCs going forward. I recommend other libraries do the same.

Of course PLOS can raise their fees to publish but that may lessen the number of submissions and put them in the middle of a competitive world. Or they can go with their hand out to those who initially funded them but that may bring to light the notion that their entire venture was a fools dream. Or they can make a discrete call to Elsevier, Springer, Wiley or T&F and say wanna buy an OA publisher?

It looks like PLOS increased its APCs for all journals in 2019 by $100.

https://www.plos.org/publication-fees

The Internet Archive has last year’s APCs here:

https://web.archive.org/web/20181209095848/https://www.plos.org/publication-fees

The most worrying thing for PLOS I’ve heard through the grapevine is that its board may be satisfied to have spun up a company in order to change things, and now that things have changed in the OA landscape, untroubled about letting the company unwind in a sort of Bush-era “Mission Accomplished” mode.

Whether the new CEO can salvage a business the board may not fundamentally care to protect could be the real question facing PLOS going forward.

The problem with OA publishing is that you can’t just wind it up in a “Mission Accomplished” mode. OA publishers should be obligated to provide for the ongoing permanent access to the content that they have published. You can’t (or probably better put, “shouldn’t”) just walk away from that obligation. This is one of the core differences between traditional publishing and OA publishing models. Anyone who claims that digital publishing is less expensive than traditional print publication has never had to pay a systems admin’s salary, or any of the other ongoing long-term maintenance costs of hosting a server.

Notionally, the surplus that PLOS was sitting on was, in part, for the long-term sustainability of making that content available. If the company (or any other) burns through that cash to sustain its current innovation (or disruption activities, or whatever), than it is not keeping up with its ethical responsibility to ensure the long-term availability of the content that it has been entrusted to publish. This responsibility of all publishers, not just PLOS, and one that there hasn’t been enough attention paid to.

PLOS deposits all its content in PubMed Central, so if PLOS ceases to exist, readers will be able to access their content, at least in some limited format, into the foreseeable future. I suppose one could argue that this is a form of taxpayer subsidy in the same way that libraries support the ongoing access to print journals (or digitized content), even when titles cease publication.

https://journals.plos.org/ploscompbiol/s/publishing-information

“All PLOS articles are archived in PubMed Central and LOCKSS.”

How can OA preservation be a problem if anyone can store the content?

Seems more of an issue with toll access publishers:

https://gitlab.com/publishing-reform/discussion/issues/22

“Can” store the content is not the same thing as “Does” store the content. For the scholarly record, we’re talking about long term (permanent?) archiving. That’s a much more difficult and expensive task than having someone temporarily host a paper on a website that may or may not be around next week, or relying on a government service that may lose all its funding at the next election cycle.

It’s a huge issue for scholarly publications, regardless of the business model, and participating in an archiving service is often seen as a sign of legitimacy for any publication. It’s why so much effort has gone into LOCKSS, CLOCKSS and Portico and why they are such essential parts of the scholarly infrastructure (see recent posts https://scholarlykitchen.sspnet.org/2018/10/17/guest-post-the-evolution-of-infrastructure-making-a-renewed-investment-in-preservation-at-portico/ and https://scholarlykitchen.sspnet.org/2018/11/06/interview-clockss-craig-van-dyck/ ).

Actually, some of this information are signs of health. PLOS replaced a CEO with little business experience with an experienced executive who came up through the commercial sector. (The executive compensation mentioned here is bubkes.) They have discontinued programs (e.g., internal software development) and they wrote down the cost of building that software. That write-down is a non-cash charge; it shows up on the balance sheet, so PLOS did not “lose” that money in the sense of cash out the door. I see evidence of the tough decisions of a turnaround. I also see no evidence of the sanctimony that characterized the early days. The jury is out on PLOS, and those who are gleefully sharpening their knives may have to wait a long time.

There seems to be a lot of churn in their executive staff recently, losing (or replacing) 5 of its 7 positions since 2018.

Gone are:

Louise Page (Publisher)

Ray Campbell (General Council)

Richard Hewitt (Chief Financial Officer)

CJ Rayhill (Chief Technology Officer)

Katie Sharabati (Director, Human Resource)

Added are:

Robyn Arville (Head of People and Culture)

Bekah Darksmith (Chief Marketing Officer)

Remaining from 2018:

Alison Mudditt (CEO)

Veronique Kiermer (Executive Editor)

see: https://www.plos.org/people and https://web.archive.org/web/20181130125214/https://www.plos.org/people

Surely most of the evaporation in assets will be from realizing a loss on the book value of Aperta rather than burning through savings? It occurs to me that journal publishers can’t win; if they make too much money it is read as a sign of a rapacious business model that requires circumvention by funder boycotts (Plan S), if they make a loss they are seen as existentially threatened.

What I don’t fully understand is how PLOS could include the future value of software that it did not implement in its net assets. If Aperta were built and fully functional, it would not have to pay another company for these services. PLOS may also had plans of selling these services to other publishers. But both of these are aspirational prospects and not current assets. Unless PLOS had plans to sell to a large commercial publisher, what reason could it have to inflate its books this way?

This is just the way accounting works. You match the capital expense to the revenue. So when you make an investment, you book it as an asset and don’t show it flowing through the income statement. When you begin to use the new product, you begin to charge the P&L over a number of years. I don’t know the particulars for PLOS, but this sounds to me to be a routine practice. PLOS has operating issues, of course, but I don’t think anyone has found something off in their accounting (thank god).