Recently, Stuart Shieber, Director of the Office for Scholarly Communication at Harvard published the edited text of a talk he gave at the annual meeting of the Linguistic Society of America, in which he praised open access (OA) as a better system for learned societies. This is an important topic, especially now because Parliamentary hearings are going on in the UK exploring how RCUK mandates may affect learned societies.

Judging from the text, Shieber’s talk argued points his facts directly undercut, argued facts he didn’t understand, and asserted realities that don’t exist, yet he failed to realize any of this.

Shieber is a relentless advocate of OA publishing, and has been a force at Harvard driving their policies in this regard. In his recent post, Shieber argues that not-for-profit publishers are more efficient than commercial publishers because they command a lower price in the market for their goods, don’t engage nearly as much in bundling, and have smaller margins. This interpretation of the facts has four obvious problems:

- Commercial publishers often publish on behalf of not-for-profit societies.

- Commanding a higher price in the market is a sign of efficiency and effectiveness.

- Having larger margins is a sign of efficiency.

- Bundling is a sign of scale, which can only occur if there is efficiency.

In short, Shieber is looking through the wrong end of the binoculars. Of course, his main argument hinges on a related piece of equally spurious logic:

. . . the reason that scholarly societies benefit from playing in the open-access APC market rather than the closed-access subscription fee market is the difference in the goods being sold. When the good is a journal bundle, the companies with the biggest bundles, the large commercial publishers, win. When the good is publisher services for an individual article, the publishers that can deliver those services for an individual article most efficiently, the non-profit publishers, win. Sure, there are economies of scale, but empirical evidence shows that the scholarly societies are already far better able to efficiently deliver services despite any scale disadvantage.

As we’ll see, Shieber’s “empirical evidence” is inadequate. He hasn’t parsed the market correctly. And the superior profitability and price advantages of publications going through a commercial publisher — whether those publications are owned by a non-profit society or the commercial publisher — make a mockery of this line of reasoning. In fact, OA will probably be done more efficiently by large commercial publishers — viz, the acquisition of BioMed Central by Springer.

Basic business tenets also work against his argument. Every business has a core set of functions — IT, legal, HR, finance, facilities, insurance, and so forth. If the organization is small, those functions take up a large proportion of revenues and staff. The organization is comparatively inefficient. Larger organizations can use systems, time zones, currency hedges, and many other techniques to increase efficiency, making the money they spend go farther. They also tend to have lower overheads — less of their revenues devoted to supporting core functions.

The assertion that commercial publishers are less efficient than non-profit publishers is just wrong. Laughably wrong. Their margins are better, their market penetration is better, and their sales forces are better. That’s why so many non-profit societies sign contracts with commercial publishers. They want the benefits these organizations can and do deliver. And there is a reason these organizations can beat the status quo of running publications in-house — they are more efficient and effective.

Of course, nothing can dissuade the true believer from the assertion that OA is superior. So, we get a litany of facts and reasoning. Let’s examine Shieber’s facts and reason a little more closely to see how much they have to be elided to fit the argument.

To start, Shieber uses the economic concept of a “complement” incorrectly, asserting that two journals complement each other in the same way hot dogs and hot dog buns complement each other. That is, when hot dog sales fall, hot dog bun sales fall. That kind of relationship does not exist between journals. It exists between audiences and journals — if there are no more druids, druidic journals disappear, for example. But Journal A’s usage doesn’t drive Journal’s B usage in any appreciable and direct way. His use of the term smacks of sophistry.

Cherry-picked facts come next. Shieber compares subscription prices between commercial and not-for-profit journals. The data he uses are a decade old, from 2002. Unfortunately, the comparison doesn’t represent reality in any year — commercial publishers publish not-for-profit society journals. A potentially enlightening comparison would be to compare three different cohorts:

- Journals owned by for-profit publishers with no not-for-profit involved

- Society-owned journals published by commercial publishers

- Society-owned journals published independently

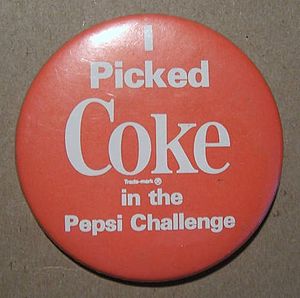

Despite using economic concepts incorrectly, having the wrong framework, and relying on outdated facts, Shieber argues on. His main observation is that price differentials are a clear sign of market failure. He’s right — in a commodity-based market. His example is Coke vs. Pepsi. These are cola commodities. While it pains me to admit, I will settle for a Pepsi when Coke isn’t available. They are, to some degree, interchangeable. But in a market that has differentiated goods, prices diverge. Think about the difference in price between a Scion and a Lexus — both made by the same company, both automobiles, but brand and features differentiate their prices significantly. Price divergence is not a sign of a malfunctioning market of differentiated, non-commodity goods. Think First Class vs. coach. Think Godiva vs. Nestlé. Think Nordstrom vs. Wal-Mart. Shieber’s economic analysis is simply wrong.

Sheiber’s thinking doesn’t even make internal sense. He notes that APCs vary greatly, ranging in his expert opinion from $0 to $3,000 (in reality, there are higher APCs on the market already). If OA is selling a commodity (peer-review, copy editing, and publication), how could prices diverge like this? And wasn’t he just claiming that price divergence is by definition a sign of a dysfunctional market? Therefore, is the OA market already broken?

He points to more out-of-date data to assert that most OA journals don’t charge APCs. It’s from a 2009 post of his examining 2007 data. The data set is no longer available via the link Shieber provides, but it’s probably irrelevant anyhow. Things have changed significantly. How much have things changed? Well, 2007 is when PLoS ONE launched. In 2008, BioMed Central was acquired by Springer. The NIH Public Access policy went into effect in 2008. And so forth. These data are from a different era.

Sheiber also brags about how Harvard was the first university to resist the “Big Deal,” but then goes on to explain how disaggregating the Big Deal landed them back at the same place, but with less to show for it. That is, they ended up paying as much as they’d paid before, but for 30 journals rather than the 130 they’d had through bundling. This hurts two of his points. Apparently, bundling is an efficient way to sell and buy journals, proving that commercial publishers are more efficient in the market. Also, it’s apparent that the best journals in the bundle is what Harvard was paying for, but in the bundle they also received some strong second- and third-tier journals, many of which probably came from non-profit societies using Elsevier as their publisher. This is what bundles do — they help send revenues across more titles, many of which come from small societies. Bundles help smaller societies. Therefore, bundling is a boon to non-profit societies using commercial publishers.

But, of course, Shieber’s goal is to convince us that OA is better for not-for-profit societies. To find a more current source of information, let’s look at an example that emerged from the Parliamentary hearings on the same day that Shieber’s post was published. In this example, we’re dealing with a UK non-profit society (the Tavistock Institute) that gleans $1,633,565 per year in revenues by publishing 60 articles per year in the journal Human Relations. Their publisher is SAGE, a commercial publisher. If the Tavistock Institute were to go to a complete OA model with attendant CC-BY licenses, the Institute would make $90,000 per year at Shieber’s proposed rate of $1,500 per article. In other words, their journal would lose $1,543,565 in revenues by shifting to OA. How does this help the Tavistock Institute?

This kind of trade-off isn’t uncommon, and it’s why societies are so concerned about unthinking mandates and policy shifts. You can see this example and many more in the public evidence available online for the UK’s Parliamentary proceedings.

Shieber throws accusations with abandon. Does the Big Deal violate anti-trust regulations? He points to a 2004 paper — one single paper — that suggested it may. What has happened in the last eight years? Based on my online searches, the answer is, “Nothing.” There was one speculative paper, and then crickets. Shieber uses the empty rhetorical trick of playing organ music to evoke anxiety.

Finally, Shieber notes that 600 scholarly societies publish OA journals. However, when you begin clicking on links in the list he points to, a 404 error or being sent to a society home page is a very likely result. It seems many of these journals have gone by the boards — journals that seem to be identified with the designation “Transfer to publisher” or “Transfer to society.” Others I looked at are publishing an article every week or two, hardly enough to sustain a robust journal’s infrastructure.

But back to the fundamental question: Is OA better for non-profit societies? Judging from what Shieber is inadvertently telling us, I’d be very concerned if I were running a not-for-profit learned society, especially in the UK. Not only are facts being twisted by OA advocates to suit a narrative, but once those facts are placed in a sensible tableau, the picture that emerges is one full of risk and penury.

Discussion

66 Thoughts on "Backfire — An Argument That OA Is Better for Non-Profit Societies Demonstrates Just the Opposite"

The mistake is to regard scholarly societies primarily as businesses. They are (should be) primarily scholarly societies, and are only accidental and incidental “businesses”. I do realise some societies are making this mistake themselves, too. Some see their publishing efforts as mere fundraising, not first and foremost as contributions to science. Laudible as fundraising may be, to use the method of closing off access to what should be public knowledge is inappropriate.

There is a deep disconnect with reality in this comment. For scholarly societies to promulgate the research, education, and advocacy that makes science central to public policy and public awareness, not to mention professional development and professional awareness, it takes money. Most scholarly societies I know balance business discipline with mission attainment very well. However, without money, there is no mission.

I’m sorry Kent, but you are not really addressing the argument, at least not in the way in which the question touches on Publishing per se. Yes, I think it can be universally agreed that Societies require money to function. However, it does not follow that all that money (or even most of it) must therefore come from the Society’s publishing program. Where is it written that the research libraries of the world be required to pay the freight?

Where is it written that the research libraries of the world be required to pay the freight?

This question is both tendentious and absurd. Research libraries that subscribe to society journals aren’t “paying the freight” for a society’s activities. They’re buying a product, and their support of the society is purely incidental. If the product stops providing good value for the price, the library is liable to cancel its subscription–even if the librarians approve of the society’s work. No one is giving anything away; all players contribute to the system in the full expectation of some kind of benefit.

Ed, no one is saying that publishing is where the money MUST come from for Societies, but the fact is that for most, it IS where it comes. There are many organizations who would love to move to OA in order to better fulfill their mission, but reliable alternative revenue streams must be found FIRST. OA w/ APC fees ain’t it.

Some see their publishing efforts as mere fundraising, not first and foremost as contributions to science.

Jan, I’m not sure you realize how deeply insulting that sentence is to scholarly societies and their work. If a society’s scientific publication program does not actually contribute to science, then it certainly should not be successful as a fundraising mechanism.

I’m afraid that each new round of Title cancellations are proving your point as we speak….

You’d be right if libraries were making cancellation decisions based purely on quality criteria, but such is not the case. In fact, we are very often canceling because we can’t afford to meet annual price increases, and increasingly we’re canceling titles of high value that we would prefer to keep.

It is often price increases that motivate us to consider cancelling journals, but decisions are based on a variety of factors – usage stats, number of authors from our university, number of times our authors cite the publication, whether there are local editors, and impact factor. This is how we measure value at our library. The biggest loser may be the monograph budget, AKA the humanities.

If the Tavistock Institute charged an APC of $27,226 ($1,633,565 / 60) for Gold OA with CC-BY, then according to the RLUK-agreed Publishers Association decision tree, an PLUK-funded author should find that their institution’s RLUK APC fund would cover the cost of that article. And if the institution had spent all its APC funds, then that same decision tree says that Green OA with an embargo of 12-24 months is acceptable.

So the only problem here is that the Tavistock Institute is proposing an APC that is way too low. Welcome to our brave new world!

The Tavistock numbers are astounding but I take it this is the high end. They are making almost $30,000 per article. If the stuff is that valuable it might be an argument for green OA. Speaking of which I see no prospect for APC OA at the US federal level. There may be a new green mandate coming but nothing gold. The federal funders simply do not want to pay for publication. This makes the gold debate somewhat academic but that is what Harvard is there for, right?

APCs transform the value proposition into a per-article calculation, which is why mega-journals have emerged — to turn a per-article game into something profitable. For subscription publishers, revenues are derived from a greater spread of initiatives, customers, and a better value proposition. Stating a subscription business in per-article terms isn’t accurate. However, it does show what transforming to a per-article modality would mean for per-article costs.

The 2013 subscription price is $2,098 (online-only) which sounds a lot for 60 articles per year. I can imagine plenty of libraries won’t be prepared to pay that much. However, they might, like us, now get it through the SAGE Big Deal, having cancelled it years ago -1987 in our case – because it was so expensive. If the Tavistock Institute was prepared for SAGE to charge less for a subscription then it would certainly need to find other ways to replace that income, but it might be good for it not to be so dependent on a single income stream, and we might not have ended up where we are: with publishers being accused of profiteering and of being the enemy of scholarly communication.

Not directly on point, but related by association: why do you (chefs) give The Scholarly Kitchen away? (She asks as she happily reads this free content over breakfast — never did that with a toll access journal!)

Because we’re volunteers. However, it’s a good question.

And the volunteer business model is. . . .?

And volunteerism is an effective business model?

Doing things for indirect benefit is an effective professional modality. Why help a colleague? Why answer a question? Why help someone else get ahead? Because it all comes back around. Why help a community tackle tough questions? Why help a great organization like SSP?

Simple answer: Karma.

Actually, I have a slightly better answer after a moment’s thought — I think we view this as analogous to a scientist’s paper. Our rewards are indirect — name recognition, reputation, personal enrichment. It’s not completely altruistic in that regard.

Exactly right, Kent. That’s a large part of the motivation of a scientist publishing with open access as well. It’s not, on the whole, altruistic, but it’s about how best to survive and thrive in the ‘publish-or-perish’ ego-system. Sharing your ideas and the results of your research as widely as possible is a good judgment call, increasingly recognised as such by funders.

Your logic breaks down because most of us here have no academic pretensions. We’re just working stiffs trying to figure things out. The “publish or perish” ecosystem demands more, and requires more disciplined venues for grant funding, academic appointments, etc. There isn’t really that much equivalency. This is just a blog.

We are branding ourselves. Ouch! Plus we have egos big as all outdoors. (Not me of course.) But a little more seriously the blogosphere is a public discussion on a new scale, a grand scale. Who can resist?

So by your own logic, this content is carries the stigma of being borne of poor “efficiency and effectiveness” — actually, no efficiency at all if we’re looking at your profit margins…

Perhaps it should be seen as a marketing effort, rather than a business model.

One could (does) argue that those two are not so easily separable. Market? To what end? Perhaps return on investment?

Why not? Why can’t we re-imagine what scholarly publishing looks like? There are plenty of examples of blogs that are excellent venues for sharing knowledge in their fields.

It may be a road to nowhere but it’s one on which tenure, evaluation and hiring committees are spending a fair amount of time. Me, I tend to think of them like breeds of dogs (a handy analytical tool in many cases). Border collies and golden retrievers are both working dogs even if their breed characteristics differ; they both behave a job to do and need training and maintaining to do it well. (OK, sub in blogs and journals there and take the analogy as far as you like — for additional fun add your favorite dog breed — I of course favor mutts). Before I shut up and get off line, I”ll just protest gently that the SK’s consistent critique of OA publishing tends toward the reductive in its assumptions about the ways and means of publishing, an activity that is increasingly and richly diverse.

For my part, I contribute to SK without direct remuneration for the same reasons I give away most of my work-related writing to commercial publications:

1. Writing for publication is part of what my employer pays me to do, so I’m not actually doing it for free;

2. If I do it reasonably well, it raises the value of my professional stock, which translates into concrete benefits to myself;

3. I enjoy contributing to the professional conversation around these issues, and derive gratification from being told that I’ve done so effectively.

Shieber’s argument is more muddled than you note here. He makes an incorrect distinction between “Open Access” and “For-Profit”. There are many journals that are both OA and for-profit (BioMedCentral, F1000, the many OA journals of Wiley, Springer, SAGE, Elsevier, etc.). There are also large not-for-profit publishers (OUP, CUP) that offer tremendous efficiencies, economies of scale and produce significant surpluses from their journals (both OA and subscription).

The notion that there is an inherent separation between OA and for-profit publishing is an absurdity, as is the notion that scale and efficiency can only come from a for-profit company. Options for society journals run along a vast continuum. It is quite possible for a society to partner with a large publishing house that is itself a not-for-profit, to take advantage of economies of scale, and to bring in a larger surplus than was possible publishing independently.

So really what is being argued here is more a question of scale and consolidation versus independence, rather than OA versus for-profit. OA inherently favors scale and consolidation, as the author-pays model offers limited choices to improving financial performance–one either accepts more papers or one cuts costs. The obvious way to cut costs without cutting the service offered authors is through scale. And that’s why OA, in the long run, will do much to entrench the biggest publishing houses at the expense of the smaller independents.

Indeed, and very well put. There was so much wrong, it was like pulling the stuffing out of a pillow. I definitely missed some because it just seemed endless.

I think your point about how OA, in the long run, seems likely to entrench the biggest publishing houses (either for-profit or not-for-profit) bears emphasis. That, in a larger sense, will be the ultimate backfire here. And if people think APCs will hold to their current price levels if the terrain changes much, they’re sadly mistaken. Once market capture is completed, pricing leverage is significant.

You mis-describe Shieber’s argument and thus this particular criticism misses its mark. Shieber is arguing OA vs. Subscriptions for small to medium non-profit societies currently running independent publishing operations. He isn’t making any argument about OA vs. profit. The key to his argument really is that the status quo means sure failure for these societies as libraries do indeed drop these subscriptions to pay for the bundles when funds get cut. So they need to change somewhere. Joining a bundle is the other option.

If that is indeed his argument, it is poorly made and unconvincing. I used the word “muddled” which is appropriate here, as he seems to throw in an entire kitchen sink’s worth of unrelated comparisons and information if the argument is a simple statement that small independent publishers are in trouble. Furthermore, there’s no reason that one should consider these two options separately. He offers clear evidence that there’s tremendous value in “joining a bundle”/partnering with a big publishing house no matter what mode of access is chosen. And as I pointed out in my comment, that big publishing house could be a not-for-profit and still provide the same advantages.

Non-profit self publishing societies have an impossible task of competing with the commercial publishers. I hear at least 2-3 times a month editors and authors asking why we can’t do things like Elsevier does. I also hear them complain about the quality of papers in commercially published journals. They complain about crappy or non-existent editing and some of them have called out editors and asked them to explain how papers that make no sense get published. But, these journals get papers published quickly and have better impact factors. The truth is that we can’t offer better author services because we can’t afford it and we don’t have as many people. The very existence of the professional society counts on large revenues from the journals. The best you can hope for is to offer specialized content to professionals in your field that they can’t get from a large commercial publisher, which has absolutely no connection to the individual market. On another note, we get asked about OA every now and again and I am shocked that authors and editors don’t realize that OA is being paid for with author fees.

I’m happy to see the Kitchen addressing Dr. Shieber’s piece. I questioned him in the comments section about his logic as the numbers simply do not add up. It’s reassuring to see I was not the only one who came to this conclusion. The fact remains that if a Society wishes to remain highly selective in what they publish there is no way for the publishing end to remain financially viable. APCs will just not amount to enough revenue. Any organization considering a switch to OA due to altruistic motives needs to be absolutely sure that they can make up lost revenue from some new stream before converting. I fear many are not thinking things through entirely and we risk the “McDonaldization” of scholarly publishing. Megajournals who accept nearly everything on every corner offering a dollar menu. Fast food is OK now and then, but there are times when I prefer to eat at a 5-star restaurant.

Sounds like every selective journal would need an ‘ugly sister’ megajournal to keep it afloat. The selective journal runs at a loss but publishes high quality content. The ‘ugly sister’ publishes nearly everything submitted to it, but makes the profit that props up the selective journal. You might say that PLoS, NPG and others have come to that conclusion already.

There is a fundamental problem in reasoning here. You upbraid Mr. Shieber for misunderstanding basic economic principles. To wit:

* Commanding a higher price in the market is a sign of efficiency and effectiveness.

* Having larger margins is a sign of efficiency.

* Bundling is a sign of scale, which can only occur if there is efficiency.

Um…no. These three things might well be true for the sort of perfectly efficient markets encountered in ECON 101 textbooks, however they rarely apply in the real world. And we are not talking about markets in the abstract — we are discussing the *particular* market of scholarly publishing, one that has been thoroughly broken and inefficient ever since Robert Maxwell realized he could soak the world…

As to point one:

* Commercial publishers often publish on behalf of not-for-profit societies.

So what? Yes, it may be a nice thing in the abstract that a Society is seeing more money than it did before, but how does that help the customer exactly? Am I supposed to be thrilled to pay *more* for the same content?

Well, you can’t have it both ways. You’re saying that a business that has lower prices, small margins, and no scale is a more efficient business? Perhaps you’d like to read what Matthew Yglesias had to say about a business that fulfills 2 of the 3 of those (in order to gain scale):

. . . Amazon, as best I can tell, is a charitable organization being run by elements of the investment community for the benefit of consumers. The shareholders put up the equity, and instead of owning a claim on a steady stream of fat profits, they get a claim on a mighty engine of consumer surplus. Amazon sells things to people at prices that seem impossible because it actually is impossible to make money that way. And the competitive pressure of needing to square off against Amazon cuts profit margins at other companies, thus benefiting people who don’t even buy anything from Amazon.

Of course, Amazon’s end game is to command higher prices and have larger margins, after it completes its market share (scale) blitz. Economics 101 has a funny way of being right.

As for societies having more money, that helps the society do more education, provide more research funding, etc. As for the subscription model, it spreads the costs more widely, which makes things affordable generally.

What we have is a funding problem, as I’ve said before. Universities and governments are increasingly benefiting from scientific research funding (through soft money) and findings (through patents), yet are squeezing the budgets for information that scientists need. This is leading to a false crisis. Higher education tuition and fees are rising faster than subscription prices, especially when you view them properly (and don’t rely only on outdated print subscription numbers).

Sorry for not being more clear. Perhaps part of the problem is that neither of us have defined what we mean by the concept of “efficiency”. One reading would be that it denotes the amount of money that can be returned to stockholders, another would be the amount of knowledge that could possibly be transmitted. Not entirely the same thing in many cases.

Please re-read Yglesias’s (admittedly charming) post. The point that he is making is that investors are *not* treating Amazon in a typically rational manner. Instead, they are banking on the notion that some future Amazon will have sufficient monopolistic leverage to start earning some real profits.

Actually, if I’m not mistaken, the relatively high margins enjoyed by some for-profit publishers is itself a sign of an *inefficient* market. In a classically efficient market, competition would drive margins down closer to the cost of production. In this case, we don’t have competition in any real sense.

You raise a couple of interesting points. I did understand that from Yglesias’ post, which is why I included it. Right now, OA is positioned to do exactly what is described there — come in at a loss, overtake a market, and then ratchet up the prices through monopoly. In fact, OA is much more amenable to consolidation than subscription publishing because the tendency is to drive efficiency to publish more articles at a lower cost. This is how PLoS makes its money — by revised and lighter peer-review standards, lack of meaningful editorial review, etc. Like Amazon, it’s a low-price, high-volume game.

As for Amazon, is it irrational to see their marketshare growth as part of a long-term investment strategy that will pay off? I don’t think so. I wish I’d invested in them years ago, and multiple times over. You explain exactly why it’s not irrational to invest in Amazon.

Again, an efficient but differentiated market has price divergence. The auto market is very efficient — prices are known, etc. But some cars cost more. And the price increases we’re talking about have actually been lower than most people believe. See this: http://scholarlykitchen.sspnet.org/2013/01/08/have-journal-prices-really-increased-in-the-digital-age/ Having prices that rise less than CPI sounds like a pretty efficient market to me.

The margins that Elsevier reports to its own share-holders for its STM portfolio have been in the neighborhood of 30%. GM is not making that. BMW is not making that either. Maybe Ferrari?

These margins are *really* high in the context of most types of business. They are typically only seen in sectors where there are extremely high barriers to competition (such as pharma). Again, this is great news for shareholders (and maybe the Societies that sell their publishing programs as well), but not so much for end users.

So, here is what I get from Elsevier’s most recent annual report:

REPORTED

Revenues: $9.54 billion

Operating Profit: $1.91 billion (20.1%)

Profit before Tax: $1.51 billion (15.8%)

Net Profit: $1.21 billion (12.7%)

ADJUSTED

Operating Profit: $2.59 billion (27.1%)

Net Profit: $1.69 billion (17.7%)

Dividends Paid to Shareholders: $833 million

Profit After Dividends: $852 million (8.9%)

So, it all depends on which profit you are looking at. I think the most realistic is the last one — money actually retained (retained earnings). And that’s 8.9%.

Elsevier also has debt of about $3.4 billion, from what I can tell. I’ve only spent about 20 minutes on these numbers, however.

Do note that Reed Elsevier is massive conglomerate. Thankfully, they have done their shareholders the service of breaking out revenues by business. For 2011, they reported total revenues for STM publishing of 2,058 million pounds and 768 million pounds in “Adjusted operating profit”. (http://reporting.reedelsevier.com/ar11/business-review/elsevier/) That comes to a not-very-shabby 37%.

Heather Morrison has reported similar margins for Elsevier’s compatriots: http://poeticeconomics.blogspot.com/2012/01/enormous-profits-of-stm-scholarly.html

Heather is not known for her astute financial analysis.

The sheet you pointed to is well known. It is also incomplete. “Adjusted operating profit” is actually a very early measure of viability in a financial statement, as my preceding example shows. So, the adjusted operating profit of Elsevier overall was 27.1%, but after you take out taxes and dividends, it’s 8.9%, significantly lower. And none of this factors in their debt service costs. Adjusted operating profit has to absorb a lot of items that come later in the financial statement. Since most of these occur at the corporate level, Elsevier doesn’t attribute them to the STM segment in the item you pointed to, I’ll bet. It’s just recursive and unnecessary.

So, I’d take that number with a grain of salt. Of course, that’s not very exciting or inflammatory, but so be it.

Most investors focus on operating margins b/c it gives the truest picture of business performance. net margins can be manipulated by tax loopholes and vary widely for multi-national co’s; and profits after dividends is also misleading b/c companies have discretion on whether (or how much) to dividend.

Yes, it may be a nice thing in the abstract that a Society is seeing more money than it did before, but how does that help the customer exactly? Am I supposed to be thrilled to pay *more* for the same content?

I thought the question was about what is best for a research society, not what’s best for an individual reader.

If subscribers have to pay too much then they cancel their subscriptions, which reduces the income of the society, unless the society increases the price of a subscription to compensate. And if subscribers have to pay way too much then they lobby funders to mandate OA. And that seems to be where we are, and why. So taking subscribers/readers for granted might not be good for the society.

Yes, which is precisely why the market is not broken. If you price incorrectly, there are penalties. However, OA is a macro response not necessarily driven by pricing. It’s been driven by primarily a belief that taxpayers somehow own everything their taxes paid for, including those things that were improved later by private entities. If you look at pricing in a modern, realistic way, it’s gone up 9% total over a decade. That’s well behind CPI. Shieber misses that one, too. He’s living in the past.

Whoa! Not for profit does not mean profitless a point Mr. Shieber misses. A well run society should have money left over at year’s end just as the Harvard endowment. When the Harvard endowment took a hit in the crash did Mr. Schieber take a pay cut or simply ask that they take a wee bit out of it to cover his costs?

I wonder why Dr. X at good ole sock em U is paid so much by the state? He teaches 6 hours per week and only one class enrolls more than say 20 students. He does this for some 7 months per year. Where is the yew and cry for lower professorial costs and the concomitant reduction in tuition, etc. ?

Perhaps governmental agencies should look and see exactly what they are getting for their dollar or pound. I just do not see many academics fleeing the feed provided by the public trough but yet I do see them attacking publishers for making a profit. I wonder….

As for Mr. Shieber, I wonder if he can sit in on any given number of classes given at the Harvard Business School in order to gain a deeper understanding of just not only economics but how business works – both for profit and not for profit.

Regarding OA be it green or purple or gold, the cost of publishing an article will go up and up, the more that is published the more people will be needed to process the endless flow of papers – the good, the bad and the ugly – that will need to be published in order to support the infrastructures of the OA organizations. The best laid schemes of mice and men. Go often awry, …

We can bash Dr. Shieber’s faulty reasoning all we want, and it won’t make a difference. OA has become a battle of ideology, like too many issues today. I fear we will have to hunker down and let the marketplace sort thing out. I just hope too many good journals don’t become casualties.

I would submit that anti-OA is no less an ideology in its own right. I agree that the marketplace has yet to have its full say — publishers that rely too much on the current model of soaking libraries for as much as they can without really providing extra value will indeed likely fail.

It may be worth pointing out that the “business” of nonprofit publishing is not driven exclusively or even primarily by strict economic criteria of efficiency. Nonprofit publishers like societies and university presses operate according to a mixture of economic and noneconomic logics, the latter including such mission-driven imperatives as maximizing distribution whether or not such maximization leads to greater profits. This explains why American university presses, e.g., opted to forego maximizing sales of hardbacks to the institutional market in favor of maximizing distribution of a larger number of copies through cheaper paperbacks, even when the overall economic return on investment was lower. But Shieber is surely wrong to infer from differences in pricing, for just this reason, that nonprofit publishers are operating more efficiently in strictly economic terms. They have multiple goals, and only one of them is to make money and maximize profit.

Profit before tax is obviously the wrong measure of profitability but deducting dividends to compute rate of return is obviously wrong too. Dividends are paid to the owners of the company. So the correct rate of return for Elsevier based on this is 16-18%

Agree with this entirely. And that’s about what any strong business needs to return. PLoS is currently beating this, and it doesn’t distribute its retained earnings to shareholders or to a larger scientific society.

Given your agreement with David, please tell me again why Elsevier’s *own* (not Ms. Morrison’s) report to its shareholders about the returns on its STM business is mistaken…

It’s not mistaken. But getting to the right percentage is more complicated, as was just demonstrated. And when you take that complexity into account, you come out at 16-18%, which is not exactly exploitative. PLoS has higher returns, no shareholders, and returns no money to societies. Remember, Elsevier’s profits are also after every one of its hundreds of non-profit society publishing partners has been paid. And since the main question of this post was “Is OA good for non-profit societies?” that’s a very germane point.

Does Elsevier offer a breakdown of what’s included in their “STM business”? Does it extend beyond journals? Are there any figures offered for non-STM journals?

STM information business in total: http://reporting.reedelsevier.com/ar11/business-review/elsevier/

It looks as if that includes textbooks (which would drag the total margin down) as well as Science Direct (which would push it up?)

Interestingly, they’re only making 14% on LexisNexis(tm): http://reporting.reedelsevier.com/ar11/business-review/lexisnexis-legal-professional/