Recently, along with my partner David Lamb at STM Advisers, I participated in a Webinar sponsored by NISO. The topic was consolidation in the world of academic and library publishing. We covered some of the basic elements of consolidation (why it happens, trends, and who drives it) and provided a primer on mergers and acquisitions. It is our view that the pace of new deals is picking up for a number of reasons, some having to do with the macroeconomic environment (the Trump administration seems unlikely to pursue antitrust cases), the sheer amount of cash in investors’ hands waiting to be put to work, and the maturity of academic publishing, which makes established companies seek to combine in order to enlarge their market share and increase their clout in the marketplace.

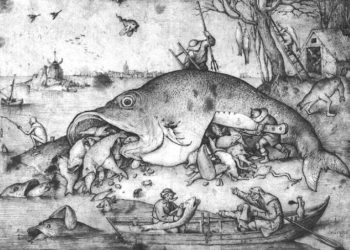

We also touched on venture capital and start-ups, which are a different kettle of fish from the consolidation we see among the larger companies. Start-ups seek to do something new (and occasionally they succeed), whereas established companies seek to make more money doing what they have done before, but in a bigger way.

We expect to see more start-ups in the future, as new technology spawns so many ideas. Meanwhile, the consolidation among the bigger companies will continue, and will sometimes involve the acquisition of some of those start-ups.

I have uploaded the slides from the presentation, which you can access here:

We would be happy to answer any questions in the comments to this post.

Discussion

8 Thoughts on "Publishers, Libraries, and the Food Chain"

Hi Joseph

Very interesting post. On slide 10, ‘These sources of capital dwarf the industry giants’? did you mean that Goldman Sachs dwarfs Elsevier as a source of capital?

A quick look at market cap shows Goldman Sachs’ to be more than 3X that of Reed Elsevier:

https://ycharts.com/companies/GS/market_cap

https://uk.finance.yahoo.com/quote/REL.L?ltr=1

The market cap of RELX, Elsevier’s parent company, is about $40bn, up three-fold in the past five years. Goldman Sachs’ market cap is about $80bn. You need to remember that the number on Yahoo finance is in sterling rather than dollars. So GS is twice the size, not three times.

For transparency, I work for RELX.

I was referring to the tech giants: Google, Facebook, Oracle, Facebook, Amazon, Microsoft. But certainly Goldman Sachs is a much more important player than Elsevier et al in the scheme of things, and as a bank, Goldman can bring far more capital to bear on any issue–if they see the promise of a return.

Where consolidation in academic publishing is very unlikely to happen is university press publishing. There have been a very few mergers involving university presses. I remember that years ago the Iowa State University Press was sold tom a commercial publisher called International Scientific Publishing. And there have been a few presses that absorbed small literary imprints, like Swallow at Ohio University Press. But theese are very rare exceptions.More prevalent are collaborations in warehousing, order fulfillment, etc. (as with the Chicago Distribution Center) and electronic publishing (as with Project Muse) that nevertheless leave the constituent presses continuing to have their own editorial identities. I suspect this will continue to be the way AAUP member presses operate indefinitely into the future.

R/E 5.7 billion, Thompson Reuters 12.6 billion T/R is a potato and R/E a small potato considering Facebook paid 19Billion for WhatsApp!

Publishers seem to buy each other up for purposes of growth. Companies like Facebook buy things up so that they can monetize via advertising sales. Publishers sell content which has a rather limited market. Even STEM readership is rather small when compared to a days readership of Facebook.

Large sovereign wealth funds (SWF) are another major source of capital.

As of June 2016 (most recent data), total SWFs stood at $7.37 trillion.