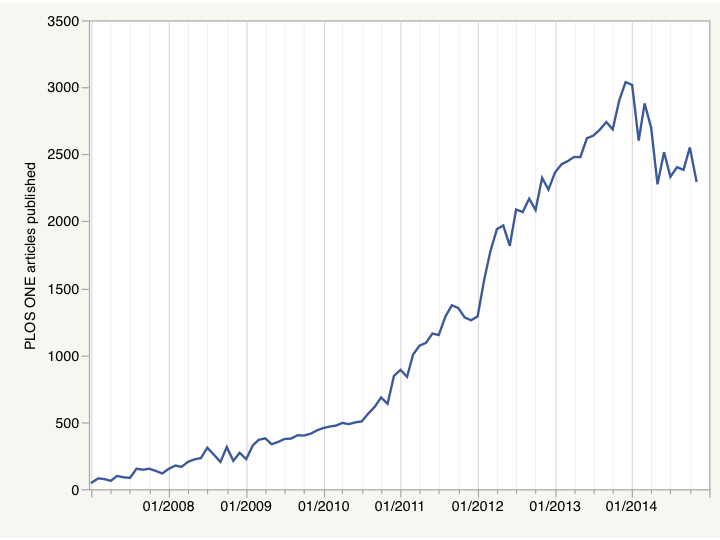

Publication output in the world’s largest scientific journal, PLOS ONE, has fallen nearly 25% since peak output in December 2013 and doesn’t appear to be recovering.

In November 2014, PLOS ONE published 2302 research articles, similar to monthly output reached two years ago. The rise and fall of PLOS ONE‘s output curve raises a few concerns about the future success of this journal and to its parent organization as well.

The Public Library of Science depends upon PLOS ONE to generate a significant stream of revenue that is used to subvent its flagship journals and keep their article processing charges (APCs) artificially low. To give you a sense of scale, in 2014, PLOS ONE published more than ten-times the number of articles published in all other PLOS journals combined. Without substantial revenue flow from PLOS ONE, these journals would either need to raise their APCs significantly or radically cut the editorial services they provide.

PLOS ONE’s massive growth over the last few years generated record revenue, according to PLOS’ financial statement. For 2013, the publisher reported that gross revenue grew by 31% to $50.8 million (up from $38.8 million in 2012). At the same time, PLOS’s expenses grew by 35% to $37 million (up from $27.4 million).

Much of that additional expense can be explained by the incremental costs of handling, processing and publishing each manuscript. As Kent Anderson details in his extensive list, publishers do lots of things, and lots of things translates into lots of expenses.

Unlike commercial ventures, non-profit organizations are constrained with what they can do with surplus cash and still retain their non-profit tax-exempt status. PLOS has no stockholders who insist on being rewarded with quarterly dividends. PLOS was started with foundation grants, not venture capital from investors, who wait eagerly to cash-in on the spoils of scientific publishing. In 2013, PLOS did what other non-profit publishers in their situation would do with a lot of extra cash–they invested in their organization. According to their financial report, PLOS invested by building infrastructure, hiring more staff and increasing the size of their US and UK offices.

While these investments sound wise, we need to remember that all of this infrastructure is based on a stream of APCs that now appears to be in flux. A new computer system may take many years to plan, build, implement, and refine. Hiring new editors and staff can be done more quickly, but people still need to be trained and may only become efficient after they have worked in the organization for a couple of years. If there is room available, a publisher could rent additional floor space but often this expansion is built on a multi-year leasing agreement with the building owner. Building infrastructure is a long-term, multi-year committment.

Prior to the downturn in 2014, one could look at the PLOS ONE publication graph and believe that growth could go on forever. One could be optimistic and plan for a future of continued growth, new staff, new software, and new office space. Since the vast majority of revenue for this publisher is tied to APCs, a downturn in publication rates makes all of these investments look more like gambles than sure bets. It’s hard to plan for the future when your revenue stream starts resembling the stock market. In comparison, a publisher dependent upon subscription revenue may plan on a 2-3% annual revenue decline and still be able to plan with much more confidence than a publisher that is dependent upon APCs.

A return to a revenue stream like 2013 looks more unlikely precisely because of the massive growth in PLOS ONE in previous years. PLOS ONE‘s 2014 Impact Factor will be calculated by summing citations made in 2014 to articles published in 2012 and 2013. As this journal was undergoing rapid growth throughout this period, the 2013 cohort is much larger than the 2012 cohort (31,498 articles compared to 23,447). As articles in their second year of publication (the 2013 cohort) tend to receive fewer citations than articles in their third year (the 2012 cohort), journals that are growing quickly tend to receive a suppressed Impact Factor.

If citation rates in 2014 are similar to those in 2013, we can expect PLOS ONE‘s next Impact Factor to remain around 3.5 and continue to be suppressed until 2016.

Given that PLOS ONE authors are sensitive to journal Impact Factor, much like other authors, submission rates are not predicted to return to pre-2014 levels. We may have witnessed the end of peak PLOS.

Based on the graph, the effect of PLOS’ data sharing policy, implemented in March 2014 does not seem to be driving authors away en masse. However, the policy does not appear to be enforced by the publisher, at least at this time. If the policies were implemented as a requirement–with publication withheld until compliance, as the reviewer form clearly states– it may also have an impact on the the journal submission preference of PLOS authors.

PLOS ONE was designed to be expandable and expandable it became. Based on the APC model, the publisher generated record income; however, it appears that that this revenue stream has quickly changed directions and is now in decline. The non-profit nature of PLOS presents significant challenges on how to plan for a future with a revenue model that may be more variable than expected. A change in research funding levels, competition from higher profile open access journals, as well as from those offering lower-priced alternatives, may make it difficult for the publisher to rely on PLOS ONE to support its other endeavors.

Discussion

26 Thoughts on "Peak PLOS: Planning for a Future of Declining Revenue"

I wonder how much of this is also attributable to the fact that PLOS ONE was, for several years, the only game in town for OA publishing with reviewing based on correctness only. Now there are plenty of competitors — though it would still be surprising if PeerJ, F1000 Research etc. were cumulatively taking a very big bite out of PLOS ONE’s pie.

How do the numbers look for the more selective PLOS journals? They now have ELIFE to compete with, of course.

Finally: with the establishment of more Gold OA funds, especially in the UK, perhaps some authors who would otherwise have gone to PLOS ONE are now paying the much higher APCs at hybrid journals — Stevan Harnad’s nightmare scenario.

I believe that Scientific Reports may be the most successful PLOS1 clone (after PLOS1 itself, that is) – data from Thomson Reuters suggest that Sci. Rep. has published 3200 papers so far in 2014, which is 13% of the papers published in P1 (although I’m not sure exactly how current the Thomson Reuters data are). I haven’t tried to estimate the total PLOS ONE-like (i.e. reviewed for scientific soundness only) number of papers out there across all journals, though.

As usual Phil a thought provoking analysis but I wonder if the reputation for trustworthiness that PLOS ONE has gained will be lost as quickly as one might expect if the IF declines and other me-too mega-journals take away potential authors. We can all have views about how PLOS ONE gained its position with the researcher community but it was so impressively name-checked when interviewing researchers last year for a CIBER project and the researcher community is so slow to give up trust in journals as vehicles for publication (no evidence here but experience) when once established that any decline might be very slow indeed.

Anthony

They wouldn’t publish my recent article until I complied with the data policy to their satisfaction.

The data policy may be part of the challenge, and was raised as a potential issue for submissions when it was brought out.

Phil a great article. It gives one pause when discussing the OA world.

At this time P1 drops about 25% of revenues to the bottom line and costs are increasing. As competition becomes more fierce (e.g. ELife) in all likelihood revenues will continue to decline and there is no reason to assume that costs will decline, but continue to rise. Thus, in say 3-5 years P1 will be a break even operation or in a truly non-profit situation.

I wonder if Springer, Wiley and Elsevier are knocking at the door….

It is not surprising that APC revenue is more volatile than subscription and carries different risks for that reason. But given the limited data PLOS1 may simply have leveled out. It may even be stabilizing.

My take is that the $1350 APC is looking increasingly unfashionable. With F1000 Research down at $1000, PeerJ at $99xn in its hard-to-compare pricing model, and the various Ubiquity journals charging ~£250, the PLOS deal no longer looks like a bargain. I think they should be working very hard to get that price down into triple figures.

Given that PLOS grants a waiver to pretty much anyone who asks for one (and I know several very well funded labs that routinely ask for them), I suspect that price isn’t a big determinant here. If there’s really that big of a hardship for your lab to spend $1350 instead of $1000, then you’d probably just ask for a waiver.

In a sense, PLOS has created a variable pricing model based on the authors willingness/ability to pay. Based on their financial report, about 10% of their expenses went to APC discounts and waivers. On the other hand, there appears to be segmentation in the OA megajournal market based on price. According to David Solomon’s survey of authors publishing in five megajournals (http://dx.doi.org/10.7717/peerj.365):

About half of PLOS ONE and around a third of BMJ Open and PeerJ authors used grant funding for publishing charges while only about 10% of SAGE Open used grant funding for publication charges. Around 60% of SAGE Open and 32% of PeerJ authors self-funded their publication fees

This suggests that authors (not all authors, David, but quite a number of them), are indeed price sensitive and are selecting publication outlets accordingly, whether they take advantage of hardship waivers or not.

Indeed it may be relevant for some authors, but I’m suggesting it’s not the driving force for the 25% drop in articles in PLOS ONE. If you look further at the numbers, APCs are funded by grants, governmental programs, institutional funds and departmental funds (and fund waivers are listed as well). APC payments coming out of personal funds show pretty low numbers (7.8% for PLOS ONE, but higher for PeerJ–though one wonders about this, as many grants may not pay for “memberships). SAGE Open is a different story as you’re talking about HSS authors who don’t have a lot of grants available (and likely aren’t going to publish in PLOS ONE anyway as it’s not relevant to their fields). So it could be having some effect, but I suspect the lure of the career rewards offered by a higher Impact Factor has a much bigger effect.

Regarding PeerJ — I paid for my own membership without it even occurring to me to ask someone to fund it for two reasons. First, it’s a thing for _me_ rather than for a specific paper, and it made sense to me that I should be paying for this rest-of-my-life thing. And second, it was just so darned cheap. A lifetime of publishing for the price of a nice meal for two? Why wouldn’t you?

I suppose it would depend on how one defines “lifetime” and how much faith one has in venture capitalists.

To me, this looks like the classic s-curve any system (and business) experiences — initial stage, exponential growth, plateau and mature decline. The question wasn’t whether this would occur. The question was when. That seems to be answered. Now, as others have noted, the questions are obvious — how steep will be the decline and what will PLOS do next?

“The Public Library of Science depends upon PLOS ONE to generate a significant stream of revenue that is used to subvent its flagship journals and keep their article processing charges (APCs) artificially low.”

To what degree are the flagship titles “artificially low”, though? They appear to charge either $2900 or $2250, which is not shockingly different from what’s being asked for an APC in a hybrid title by a mainstream publisher – OUP and CUP ask for about $2700, most Elsevier titles average $2500-3000, Springer ask for $3000, T&F $2950, Wiley mostly $3000.

These are a little higher than PLOS X but not dramatically so, especially given that hybrid APCs tend to be higher than all-gold titles from the same publisher.

(I’m assuming here that “flagship” is the other six titles; if we’re referring just to Biology & Medicine, then the APCs are bang in the middle of the price range)

In terms of relative income…

Two titles charge 2900 USD (~500 papers in 2013, income $1.45m), and four charge 2250 USD (~2800 papers in 2013, income $6.3m). PLOS One took in $42.5m from ~31500 articles. Total $50.25m (they actually reported just under $49m, but delays between payment & publishing may account for this).

Assuming APC waivers are evenly distributed, this means the flagship journals are already bringing in 15.5% of the income for 9.5% of the papers published. Operating these titles no doubt is more expensive than PLOS One, but they still seem to be contributing a fair chunk of the operating costs.

I think the idea behind “artificially low” is that the journals are not self-sustaining at their current APC rates, and rely on a subsidy provided by PLOS ONE authors. Take away PLOS ONE and the journals would have to charge a higher APC (or find some other source of revenue) to cover costs.

I suppose my question is – do we actually know that they’re not sustainable at this rate? Have PLOS said so? (I am quite prepared to believe they have, I just don’t recall seeing it anywhere).

The numbers aren’t really leaping out to me as being financially unsustainable, as the basic APC feels like it ought to be more than enough to cover costs even in a smaller operation – if a commercial competitor could do it at a similar rate, why not PLOS?

I don’t know if it has been publicly stated, but it is my understanding that this is the case. The sustainability can’t really be judged by the raw number charged to the author. First, you have to take a look at the journal’s editorial policies–what are their rejection rates? A journal like PLOS ONE, which accepts the majority articles that are submitted, earns revenue from the majority of submissions. PLOS Biology, which has a high rejection rate, only earns revenue from a small percentage of submissions. The costs of rejection must be covered. For comparison’s sake, eLife, a similarly selective journal, spends $14,000 per article published.

Also, you can’t compare costs at a small operation like PLOS to those at a huge company like Elsevier. You’re talking about the overhead and infrastructure being paid for by less than 10 journals, versus amortizing those costs over thousands of journals. The economies of scale make an enormous difference.

The $14,000 figure for eLife is fascinating (and rather terrifying). Where is it from? Does it include any kind of breakdown?

Kent wrote about it here:

http://scholarlykitchen.sspnet.org/2014/08/18/how-much-does-it-cost-elife-to-publish-an-article/

Basically it comes from taking their 2013 expenses and dividing by the number of articles published in 2013. The number is pretty much in line with predictions made by Cell, Nature and Rockefeller University Press about what they would have to charge if they went completely Gold OA.

Oh, OK. That’s a useful calculation to have made. But it would have been more interesting had eLife themselves announced the $14k costs together with a breakdown of where the money goes. I’d have been especially interested in knowing what proportion of that cost goes to cover submission that were not ultimately published.

eLife’s financial report is available here:

http://2013.elifesciences.org/#figures/f3d04cc8bb7c8d882492f5b21a03a6a7/

It’s not broken down in a particularly helpful manner, but it might be very difficult, even internally, to determine the number you’re seeking. How much of overhead costs would you attribute to each rejected article? Some things are easy like costs per submission for your submission system, but how would you allocate air conditioning and electricity used in the process of rejecting those articles? Looking at overall costs and overall output may be more effective.