When the term “non-profit” is invoked in our industry, and in society at large, it is often used as a badge of honor. Many of us, and our customers and users, ascribe certain virtues to non-profit organizations merely based on the type of business established.

It’s common to assume that the charitable purpose or higher goal of a non-profit will lead to slightly better and more admirable behaviors. There are many examples in this regard. Most non-profits do tremendous things for society. At the same time, some are ruses at best, corrupt at worst. Some non-profits have been accused of funneling money to terrorist groups, facilitating self-dealing schemes, and more. It’s in these instances we’re reminded that “non-profit” is a tax status and a set of constraints (not always honored) about what can happen to the assets of the organization. Being a non-profit is not a guarantee of good behavior or more benevolent or wiser business practices.

There are non-profits that are large and powerful, generating hundreds of millions in revenues on high margins. There are also commercial for-profits that are small with slim margins. Yet, the market is portrayed as if we assume “non-profit” means “small and quaint” while “for-profit” means “big and bad.”

There are many ways of organizing businesses, of course, and many hybrids — LLC, S-corp, C-corp, privately held, public benefit corporations, and others particular to certain economic regions or nations. Companies can consist of multiple types of businesses at once, as well. Non-profits can and do have for-profit subsidiaries, for example.

The recent news that the Atlantic is being sold to a entity (Emerson Collective) funded by Steve Jobs’ widow and transitioned via an LLC structure into a non-profit helps to illustrate the variety of options available to companies and their stewards these days:

Emerson Collective is blazing a path increasingly popular in Silicon Valley by disbursing its money through a private limited liability company — or LLC — instead of a foundation or philanthropy. This structure allows for both for-profit investments and traditional charitable activities. It also comes without many of the nonprofit world’s restrictions on political or issue advocacy. Other groups arranged in this manner include the Chan Zuckerberg Initiative, created by Facebook co-founder and chief executive Mark Zuckerberg and his wife, Priscilla Chan.

The Chan Zuckerberg Initiatives (CZI) has recently been active in scholarly publishing, acquiring Meta and grant-funding bioRxiv. CZI is itself an LLC, which likely means it’s a pass-through to Mark Zuckerberg, giving him tax advantages as he distributes philanthropically.

We’ve seen transitions of business model type, as well, notably in recent memory when HighWire Press went from a non-profit to a VC-funded for-profit. This switch from a non-profit made it easier for HighWire to raise funding and diversify its operations. When SSRN was acquired by Elsevier, there was some confusion about how a non-profit could be sold — SSRN was never a non-profit, but its behavior (embrace of open principles and early forays into preprints) had convinced some that it was. More recently, consternation arose when bepress was acquired by Elsevier, with those concerned forgetting that bepress had sold its journals portfolio to De Gruyter a few years ago for an undisclosed sum and has always been a commercial entity.

Non-profits exist in the same financial system as any organization, so they need to generate revenues in excess of expenses. They usually call these “surpluses” rather than “profits.” Often, these are saved as retained earnings in an investment fund that may be called an “endowment,” which may commingle with donations or bequeathed funds, which are truly endowments. In many cases, these investment funds rely on returns from the stock and bond markets, creating a reliance on for-profit firms’ performance, even if that risk is pooled in instruments like indexed funds or the like. In 2007-8, many non-profits and higher education institutions suffered significant setbacks as their investment funds cratered when the housing bubble popped.

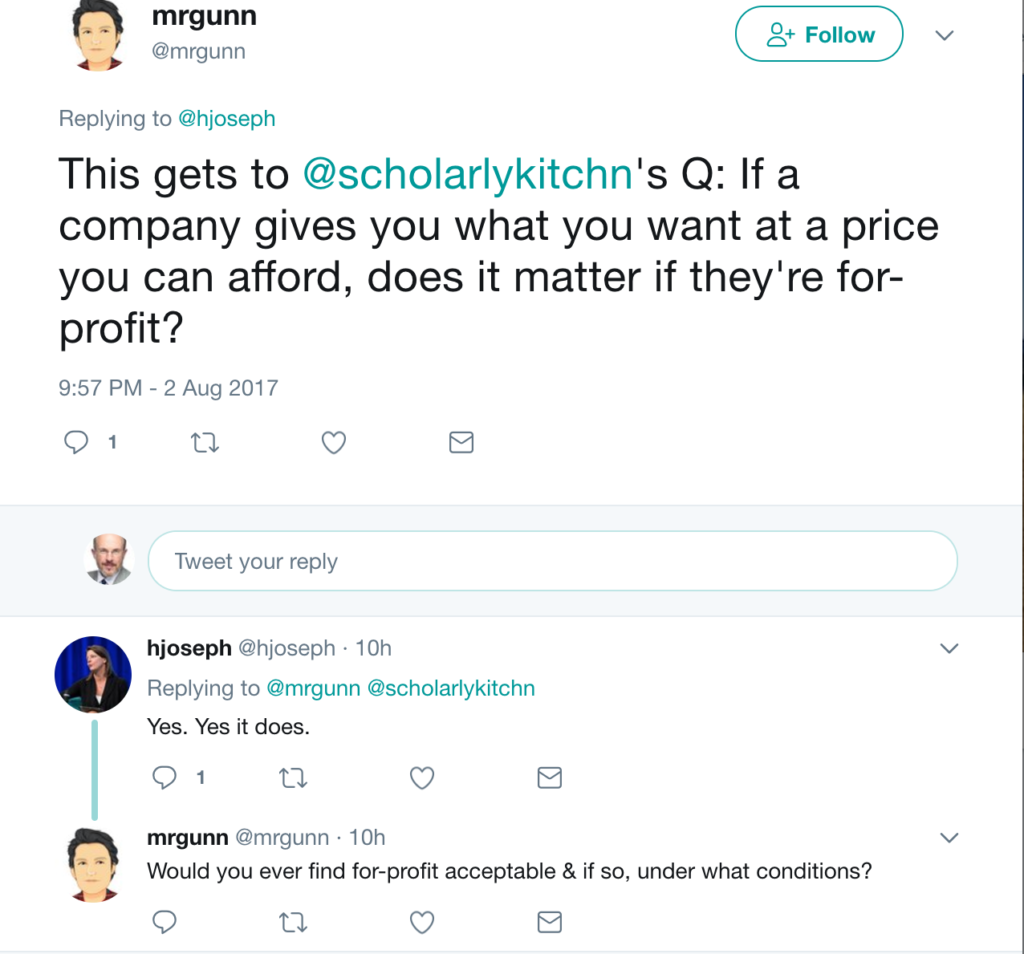

The tension between some stereotypes of for-profit firms and non-profit firms was recently on full display as William Gunn and Heather Joseph exchanged views on Twitter. You may recall that Gunn is with Mendeley, which Elsevier acquired in 2013.

This assertion coming from a strong advocate of OA invites the question: If for-profit firms were to flip the market entirely to OA and dominate an OA market, would that be acceptable? That is, would these ends justify those means? Candidates for doing this include such for-profit entities as PeerJ, F1000, and ScienceOpen, in addition to SpringerNature, Wiley, Elsevier, and others.

Why are some for-profit firms perceived as benevolent while others are not? In a recent interview, Scott Galloway, a professor at NYU’s Stern School of Business, talked about why some companies get scrutinized while others don’t. It perhaps has bearing on why some for-profit firms in our sphere seem benign while others draw ire. In this context, Galloway is talking about why Facebook, Amazon, Google, and Apple seem to evade normal anti-trust scrutiny:

[The successful big tech] companies all wrap themselves, smartly, in a progressive pink or rainbow blanket because progressives are seen as nice but weak, and conservatives are seen as smart but mean. . . . A progressive running tech companies is the right algorithm because they’re seen as nice and weak. That’s how we’re seen. As a proud progressive we’re seen as too nice to be Darwin and Ayn Rand and take over the world, which is what these four companies are doing. If you had a hardcore Republican running any of these companies, it wouldn’t work. It just wouldn’t work.

The images projected by for-profits like F1000 or PeerJ or ScienceOpen don’t fit the images we have of for-profit firms, reflecting perhaps a cultural difference, and likely not something as cynical as Galloway may be suggesting. Yet, it’s a familiar perceptual gambit, harkening to the image embellishments a Gates Foundation or CZI might provide their founding billionaires. It also underscores that the way a business is organized does not determine everything, or even most things, about the firm’s conduct or reputation.

Outside of the US, there are other business designations we encounter. Non-profits in the UK are “charities” or “public charities.” A variant in the Netherlands known as the BV is something you might have seen after Elsevier’s name. The BV is akin to a US LLC, a British Ltd., or the German GmbH. These are taxation and regulatory statuses, just as the non-profit designation. Even among non-profits in the US, there are various types — a 501(c)3 is not the same as a 501(c)6, and some 501(c)3s have affiliate 501(c)6s. The latter can make political donations and lobby, the former cannot.

Members provide an anchor for non-profits, in both the positive (connection) and negative (albatross) connotations of that term.

Despite all this variety, we still tend to prefer non-profits, so much so that some organizations use this label strategically, especially with their academic audiences (authors, reviewers, editors, readers). Yet, even the term “non-profit” can be surprisingly slippery when you get right down to it. We don’t always know what others believe about an organization when we describe it using the term “non-profit.” Here are some actual beliefs senior academics have articulated to me over the years about non-profits:

- Non-profits can’t generate profits of any sort (no surpluses), so their pricing is only based on cost-recovery

- Non-profits are mission-driven, which separates them from for-profits, which are not

- Non-profits are more ethical

- Non-profits care more about their members, users, and customers

- Non-profits are “in it for the long haul”

It doesn’t take more than a few moments to see the incompleteness of these ideas:

- Non-profits can have surpluses or profits, and many do. Some non-profits have large stores of retained earnings, with millions or hundreds of millions of dollars salted away. In many cases, the balance of retained earnings compared to operating revenue is so significant the non-profit behaves more like a financial investment house than a business. You can learn a great deal about any particular US-based non-profit via GuideStar. Other governments provide similar disclosures.

- Most for-profit businesses are focused on a mission. For example, Google’s mission is to “organize the world’s information and make it universally accessible and useful” while Amazon’s is “to be earth’s most customer-centric company.” Facebook’s mission is to “give people the power to build community and bring the world closer together.” Mission statements in the for-profit world are ubiquitous and often quite compelling.

- Non-profits are mostly ethical, but can also struggle with conflicts of interest, financial scandals, insider-trading, and more. Their tax status as a non-profit does not shield them from internal malfeasance or external scandals.

- Non-profits often lose touch with their members, and struggle to overcome the echo chambers of their governance structures. More importantly, especially today, many non-profits have customer bases that are far larger and more diverse than their membership bases, so focusing on members may actually function as a type of myopia or limitation on how they think about their addressable market. These limitations may be baked into bylaws.

- Non-profits may be in it for the long haul in concept, but in many cases they aren’t nearly as old as some for-profits, especially in our world, with many non-profits coming into being in the 20th century while some of the more established publishing houses stretch back much farther. Some non-profits have been forced to close because of mismanagement or bad luck. A survey in 2008 by the Brookings Institution found that 70% of Americans feel non-profits waste “a great deal” or “a fair amount” of money. If true, that does not bode well for their long-term survival.

The mission-driven aspect is worth pondering more deeply, especially in light of a recent interview with Reid Hoffman, a tech entrepreneur and venture capitalist who founded LinkedIn and participated in the founding of PayPal (emphasis added to underscore the clarity of the LinkedIn mission):

. . . the companies I most like to be involved in are fundamentally mission driven; that we’re all essentially service to the mission, right? So part of the mission for LinkedIn is how do you enable every individual to maximize their own economic opportunity and the control over their own path? Whether that’s investing in skills, finding jobs, opportunities, being entrepreneurs, the whole thing. So for us, it has always been, from the very first time that we started doing whiteboarding, was how do we get down to daily benefit to users?

It’s entirely possible that successful firms — for-profit or non-profit — have clear missions they pursue relentlessly. Being mission-driven is certainly not something only non-profits can claim. Many for-profits have compelling and important missions, while some do not. Sadly, it’s my experience that non-profit missions tend to be imprecise and sporadically pursued.

For-profits often do things that may seem counterintuitive. For example, open access (OA) is increasingly dominated by commercial firms, rather than non-profits. Why? Because it makes long-term strategic sense, and because for-profits generally do a better job of following the money. They also have more liberty to pivot or adjust their businesses than non-profits, which can seem comparatively hidebound because, well, they have more hide — more committees, more sections, more board levels, and so forth. Membership itself can tie up a non-profit. Members can provide an anchor for non-profits, in both the positive (connection) and negative (albatross) connotations of that term.

For-profit firms can be rapacious, and there have been many examples of poor behavior in the for-profit sector — from banks to drugstore chains to publishers. Some for-profits pursue profits at the expense of all else, and the prior decades’ pursuit of “shareholder value” without regard for community, worker equity, or the general welfare certainly has been enough to not only make us scrutinize for-profits carefully, but also to prefer advanced forms of the corporation, such as the emerging “public benefit company” formation and other approaches. That said, there’s no evidence I’ve seen that scandals, mismanagement, or other behaviors we might find objectionable are more or less prevalent based on tax status or corporate structure. The causes seem to be rooted more deeply in individuals, cultures, or poor responses to black swan events.

In our industry, for-profits have been major drivers (along with non-profits) in major initiatives we all have benefited from, such as the DOI standard and the start of CrossRef.

In our industry, for-profits have been major drivers (along with non-profits) of major initiatives we all have benefited from, such as the DOI standard and the start of CrossRef, which itself is a non-profit. Currently, a number of for-profit and non-profit organizations are working together to advance new access control methodologies that will benefit users and increase security across our industry. This equanimity and cooperation is laudable, as it shows we can move beyond labels to serve a common customer set.

The positive associations we make with the term “non-profit” may be part of the larger competitive problems they face. It’s the “participation trophy” of business. Some non-profits still strive for the brass ring — or, more commonly, particular leaders, managers, and staff do — but the cultural sense of already having achieved something by being labeled a non-profit can drive counterproductive board and management conservatism. I’ve actually heard a number of boards of non-profits say that they can’t make too much money or they could lose their status as a non-profit. This may lead to the puzzle that Joe Esposito described in his classic post about why non-profits have less “cargo.” The feeling that something has already been accomplished because an organization is non-profit may be the second edge of the label’s double-edged sword.

Look beyond the label when assessing the competence, value, values, and character of an organization. For-profits can have enlightened management and good corporate practices. Non-profits can suffer from lassitude and organizational inefficiencies. There is no magic to the way an organization is structured relative to the tax code or asset disbursement. For-profits and non-profits can both fail or thrive due to factors other than how they are organized with regulators. Striking that right balance of progressive management, solid ethical conduct, positive market presence, excellent and adaptable strategies, and efficient operations is tricky, but to spot it, we need to move beyond the labels we casually apply and wield.

Discussion

9 Thoughts on "Beyond Labels — Does the Type of Business Matter?"

Many thanks for an interesting and thoughtful post, Kent.

I recall someone saying a few years ago that not-for-profit is a status and not an objective, which sums it up quite well!

As one who lived in the non-profit world we would often say that non-profit is not profitless!

Profit is need for innovation, good works, keeping the lights on, and a myriad other projects and things.

To answer Kent’s question posed in the title of his article posted today on Scholarly Kitchen, “No, it doesn’t.” Why? In both cases, money is involved – call it profit, call it surplus, it’s the same thing. Fiduciary responsibility and the obligation to provide value is also the same – the difference is that in the non-profit world, you have often have a large group of highly paid individuals from middle management up to the C-suite who know little to nothing about fiduciary responsibility or providing customer value. The genie is now out of the bottle. Does Scholarly Kitchen have the nerve to explore this a little bit further? If so, I’d be happy to author an Op-Ed piece on it, given my experience in both “worlds.”

I don’t think “nerve” is an issue for our authors. See:

https://scholarlykitchen.sspnet.org/2011/10/24/governance-and-the-not-for-profit-publisher/

and

https://scholarlykitchen.sspnet.org/2013/11/13/professional-associations-and-the-strategy-gap/

and

https://scholarlykitchen.sspnet.org/2016/02/22/guest-post-kent-anderson-how-can-non-profits-improve-their-governance/

I think it actually may be. What I am very clearly saying should strike a nerve with the readers of the Kitchen – the issue with non-profits (specifically the ones that I’ve worked with in the STEM field) lack the practical for-profit experience to run a non-profit more like a for-profit. With more and more CEOs coming on board with a mission to change their organizations, they are finding they don’t have the “for-profit” skill sets necessary among senior management to do what they’ve been tasked to do. The articles above put the argument in what I call “association-speak” – softening the blow somewhat. What I am very clearly saying is that a large part of your readership lack the skills to implement meaningful change. While publishing divisions are often way ahead of their membership, policy and education colleagues in terms of skill sets, most of your readership no longer has the option to look at both sides of their internal divide separately anymore – after all, they are largely serving the same customer groups. Please do let me know if you’d like for me to submit an article explaining my position.

An interesting post, but I’d like to offer up another alternative to both profit or non-profit – cooperative. I know we often think of granola and organic lettuce (in the U.S. anyway) when we hear that word, but billions of dollars of business is conducted cooperatively worldwide each year. Things like condos, rural electrical coops, and savings and loan associations.

Because the people providing the service are the same people benefiting from it, this business model can cut through a lot of the problems you mention above. The Rochdale Principles, upon which modern cooperativism is formed, try to mitigate the problems you mention. These principles include; Voluntary and Open Membership: Democratic Member Control; Remember Economic Participation; Education and Training; Cooperation among Cooperatives; and Concern for Community (more at http://ica.coop/en/whats-co-op/co-operative-identity-values-principles )

I co-authored a short article on the subject a few years back :

Schroeder, Robert, & Siegel, Gretta E. (2006). A Cooperative Publishing Model for Sustainable Scholarship. Journal of Scholarly Publishing, 37(2), 86-98.

There are a lot of ways to organize to accomplish goals. How you organize may say something about your goals, but ultimately, how you behave and work to succeed says a lot more. I think that goes for cooperatives, as well. They are often undercapitalized, A/R issues plague them, and cash flows often elude them. Some can overcome these intrinsic problems, but it’s a harder hill to climb.

Kent—

Provocative article. (I’ve made some annotations.)

To answer your question: “Yes it does.”

I founded Hypothesis (https://hypothes.is) as a non-profit and chose that model deliberately, so perhaps I can share the reason why.

First, though, most of the points you make I very much agree with. For instance:

Non-profits are not inherently better than for-profits.

Non-profits can be run just like a business in all respects except their capitalization and financing options.

For-profits can be mission oriented just like non-profits.

Many non-profits are quite poorly run, undercapitalized, etc, just as many for-profits are.

Non-profits can suffer from the same ethical problems for-profits can— since they’re run by humans.

Non-profits are not inherently any longer-lived or permanent than their for profit counterparts.

Just organizing as a non-profit is not an accomplishment in and of itself.

You need to look beyond labels in assessing the competence and values of an org.

It’s also important to state for the record that I’ve founded for-profit tech companies too. My first company, GetThere, launched the online travel industry in 1994, was VC-funded, went public with over 500 employees, and was later acquired by Sabre where it is still a wholly owned subsidiary and processes over $10B a year in travel for them. We couldn’t have done what we did as a non-profit. I’ve served on three other boards of for-profit startups, and imagine I may be involved in others in the future.

But your article misses one key reason that many tech non-profits have for choosing to incorporate as such– and why it’s much more than just a label.

Most importantly: the VC funding paradigm requires an exit. It forces your framing, your thinking, your planning and your strategic choices to exist within approximately a 7 year timeframe. Inside that period you need to figure out, and convincingly argue, how you will return sufficient capital in order to make the investment worth it to the limited partners. That means that in the scholarly space, for example, your narrative is probably to be acquired by one of the larger players— since few if any startup IPOs happen here, and VCs generally look poorly on investments whose strategy is simply to become profitable.

This creates tensions that can be quite counterproductive. What if your mission is provide an essential technology or service that really needs to be long lasting, user-aligned, and independent of any of the major commercial players in the space? Certainly you can’t guarantee that by forming it a non-profit you’ll have any better chance at being successful— but at least you’ll have control over your destiny and the ultimate use of the technology you’re building in a way that’s difficult to achieve in the for-profit world.

I wrote about this phenomenon in February when I learned of the decision that Meta’s board had made to be acquired by CZI. I think it speaks directly to the topic here.

https://web.hypothes.is/blog/opening-meta/

Thanks for opening the conversation.

One person’s counterproductive pressure is another person’s motivation. Being forced to be efficient on the market isn’t something unreasonable, especially if the timeframe is 7 years. That’s a pretty long time to find your feet. Acquisition is not something unique to for-profits, either. Non-profits can be acquired via an asset acquisition, and Purdue’s play for Kaplan provides yet another twist on corporate mergers and acquisitions. Deals can go in either direction.

I don’t think tax status has a particular bearing on funding, ramp, autonomy, or success. For example, in the annotation space where Hypothesis lives, a company like Genius shows that a for-profit can have control over its destiny, and succeed by pivoting well (from rap music markup — it was originally called Rap Genius — to some major news outlets, including the Washington Post [https://www.poynter.org/2016/2016-annotated-how-the-washington-post-has-used-genius-to-explain-the-twists-and-turns-of-a-crazy-election/421217/]). This apparently successful pivoting (from rap to include mainstream music, and then to mainstream media annotation) seems to indicate control over their destiny and the ultimate use of the technology they’ve built. The pressure to succeed may have made them pivot sooner and think more creatively about their options, actually.

Of course, the non-profit status can help in some cases during early phases by attracting grant money. PLOS was catalyzed in this way, and others have been, as well. Not all succeed, and the grant money is usually for far shorter periods than VC money (lasting 1-3 years in many cases). And, as many have found, that romantic period of funder patience fades soon enough, after which the non-profit has to make its way in the market like anyone else. As you wrote yourself in the blog post above, “Tech non-profits are hard to start, and they’re hard to start because they’re incredibly hard to fund.”

Some non-profits succeed well, but I think it’s for reasons far beyond their tax status or business structure on the market.