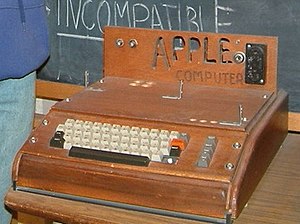

- Image via Wikipedia

Publishers often feel that they’re taking “the long view” as they cultivate authors, develop multi-year plans, and reassess their catalogs and offerings.

But could that long view be an illusion? Is it just focusing on the far end of the box they’re inside? The box that seems to be cluttering up everyone’s information basement these days?

Are they inherently set up to fail the future?

What happens when changes threaten deep disruption? Do publishers have the tools and approaches they need to respond with a truly long view?

A recent blog post in The Atlantic’s “Ideas” area touches on the problem facing book publishers — that is, instead of cultivating new talent and finding ways to adapt to modern reading habits, they’re hunkering down and creating a business with an over-reliance on blockbusters, essentially milking what’s left of their existing model.

The upshot? Instead of modern-era Faulkners, Hawthornes, Bellows, or Vonneguts doing interesting e-book syndications or mixed-media experiments with long-term publisher support, incumbent publishers are rejecting authors and manuscripts at a much higher rate than usual, shunting those people elsewhere, feeding new-style competitors by basically handing them talent.

The option offered by the Atlantic blogger — create a tax subsidy to offset risk in cultivating new authors — seems to echo faulty “save the planet” rhetoric. Claiming that societal interest in books means publishers have to be saved is backwards and imprecise in the same manner as “save the planet” is. Publishers’ self-interests should be sufficient to align their activities with society’s interest in reading — if publishers held a truly long view of the situation.

Meanwhile, players outside publishing — Google, Amazon, Apple, and others — are taking more experimental views and investing in long-term plays in our space. (That’s the 1976 Apple I in the photo above. Imagine if that had been a first draft of a novel these days. We’d never have seen the iPhone.)

I think that’s part of the reason we sometimes get so distraught by some of the new players — they’re thinking of things and doing things that we should be thinking and doing, and finding ways to fund and take a truly long view.

The same problem may face us soon as we move forward into the social media era. In an interesting post at the Community Roundtable, Rachel Happe talks about how expectations of current business can lead to underinvesting in future business:

CxOs want and need to see these new approaches replace the volume they currently get with traditional methods. The problem? Current methods of marketing investment are linear – you spend X in direct response marketing and you get y in return… and there are fairly robust benchmarks to indicate whether you are on target or not. It also scales up and down predictably – if I spend twice as much I get twice the response rate. Communities look more like hockey sticks. Initially they require a lot of investment – and have disproportionately low returns. From a measurement perspective, they look like failures for a long time before they look like successes. Over time however, communities see geometric returns that you simply can’t achieve from traditional methods and that is when the costs start dropping dramatically relative to the returns. But that gestation period is different for different types of communities and it requires an act of faith to invest heavily in something for a long enough period to see those returns start to happen.

Facebook and Twitter are able to operate more purely out of vision, bankrolled by venture capital funds meant to take them far enough to realize the returns while publishers (newspaper and book publishers, in particular) are saving themselves poor by failing to invest in getting ahead of the change that threatens to ultimately undo them.

It’s classic disruption per Clayton Christensen.

Unlike The Atlantic author, I think the future they’ll fail isn’t society’s future. Narratives, news, and social media will flourish even if some short-sighted players or current approaches to delivering these fall by the wayside. So I don’t feel let down by newspapers or traditional book publishers.

In fact, I think they’re failing themselves, and nobody else.

Discussion

8 Thoughts on "Positioned to Fail the Future"

These are all symptoms of a bigger problem are they not?

Publishing

Car manufacturers

Banks

You name it

All having to bend to the needs of two groups of current customers. The ones they sell product to. And the Shareholders whose dividends they must meet. If the two interests align, all is well, but if they don’t…

If shareholders are not about making longer term commitments to investments (and the evidence is that in the years before the fall, they were chasing the biggest hits in the shortest space of time) then there was no way investment in speculative new business approaches is ever going to fly. The shareholders won’t support it, because it’s better for them to move on to the next growth player than to play a role in the ongoing viability of whichever investment it is is that they are currently into.

It then follows that most CEOs aren’t about to put their heads above the parapet, and that approach then cascades down through the industry.

I cannot help but notice that the rise of the “free” business model coincides with the arrival of historically cheap debt financing. No wonder ‘Free’ looked so attractive when the cost of debt had seemingly been magicked down to incredibly low levels.

When reality hits (and I don’t think it has yet – not in the places it needs to), and economics comes back to the business of making things, perhaps we can get back to investing in the future in a real sense. I just hope we are still around for that.

Kent – this is a great post. I think many media and publishing companies got a little structurally lazy since they had such a big fat pipe for so long (this doesn’t apply to all) – and forgot about disruptive change… so didn’t plan it into the business structure. To be fair, information-based businesses have not gone through such fundamental changes since the printing press.

In regards to David’s comments, it is partly the information economy itself that is putting short-term pressure on corporate performance. With the onset of the internet, people can follow along neurotically – and trade neurotically – minute by minute. Hard to take the strategic view when you are watching every fluctuation. We now have an over-abundance of information and as humans we are driven to hoard, not filter. But hoarding data keeps people from taking the long view. I don’t have an answer to this exactly but you are right on point. Too much thinking about the problems of today and tomorrow without thinking about what will happen next year.

Thanks for using an excerpt from my post here. Really critical discussion to have.

The problem with the “act of faith to invest heavily” in building communities is that the vast majority of the hockey sticks she describes actually turn out to be more like, well, sticks. They start at a low level, continue on at that low level, then the money runs out. How many social networks or messaging systems were started that didn’t turn into Facebook or Twitter? Venture capitalists expect the vast majority of their investments to fail, and they hope for one or two big hits to pay off the failures and turn a profit:

What’s the Venture Capital funding model ? Fund 10, hope the 1 or 2 winners more than makes up for the 8 or 9 losers. That’s right. Most VCs expect to have at least an 80pct failure rate.

Sure, Google and Apple can afford to lose hundreds of millions of dollars in failed experiments. So can the big publishing conglomerates. And it’s easy for the Facebooks and Twitters out there to be brave with other people’s money. But what about the smaller scholarly publishing houses? Should we really be expected to invest like the big boys? Can we afford to throw money after the latest short-lived trend? Is there a more cautious approach toward seeing what really sticks and is really useful that might serve us better?

And even if you succeed wildly like Facebook, what happens when you’re no longer the flavor of the month? Take a look at what is happening to Myspace now–was that a good investment of $580 million for Rupert Murdoch?

2 Questions…

1) What is to stop publishers going after VC investment? Startups can do it, why can’t we?

2) O’Reilly have managed to ride the storm. Their business took a very big hit from Google at the start of this decade. Their business approach was driven by that event and they seem to have diversified very nicely into things that are still Publishing. If they can do it, why can’t we?

My point above, was that the model of build-test-learn-iterate cannot succeed when it isn’t entered into the finances as an essential enabling business component, due to the need to meet external short term obligations.

Nick Bilton (New York Times) made a point at TOC09 this year – “I rang up a bunch of publishers and asked to be put through to the R&D department – most didn’t even know what I meant…”

I think every publisher should have an R&D capability of some sort.

Great points, David. Your questions are rhetorical and important. And a great quote from Bilton. Thanks.

1) I’m not sure that most scholarly publishing houses are dealing with revenue on a high enough level to attract VC funding. Most of us serve a fairly small community and can’t offer the enormous payoffs that VC’s are looking for. Those publishing houses that do reach larger audiences and high revenue levels are the least likely to need outside investment. There are publishers who are supported by charitable funding (the PLOS journals as one example, with funding from the Moore Foundation). Most publishers are wary of becoming completely reliant on donations for their existence though, and even PLOS is doing what it can to try to become sustainable on its own.

2) O’Reilly is a great example, and we should all keep a close eye on their successes and failures.

I do agree that we all need to experiment and be open to new ventures, new ways of doing business. But most of us can’t afford expensive experimentation with no obvious business model/payoff (see the Nature Network as an example). Every publisher should be doing R&D but I don’t think we all need to be flooding the market with costly social networks that may one day pay off, IF someone ever figures out how to make that work and IF our readers ever show any interest in using them whatsoever. Those are big if’s for small companies to risk significant chunks of money. There are smarter ways to invest in the future than jumping on the latest trend, particularly when that trend has no obvious pathway to revenue generation.

Revenue levels may matter, but perhaps not as much as margins. STM publishers still generate enviable margins, and reliable ones. They also are mission-driven to a degree that reassures investors. I think the right VC interested in reliable returns at above-average levels should take a hard look at a portfolio of plays in our sector.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e6d1989f-64c0-4769-b509-7222b0ec0de9)