Companies buy other companies at the intersection of strategy and opportunity. For there to be opportunity, the first requirement is a willing seller (hostile takeovers are truly rare and not likely to occur in scholarly publishing). The second requirement is the ability to finance a transaction, which tilts the playing field to the for-profit entities, which have greater flexibility in approaching capital markets. As for strategy, it’s important to recognize that companies don’t acquire other companies willy-nilly: there has to be a rationale or investment thesis to explain why two entities are worth more together than they are on their own. Both strategy and opportunity have now moved into position for large scholarly and research publishers to consider acquiring college textbook publishers, which would reduce the number of publishers overall and result in much greater industry consolidation. The investment thesis centers on the “inclusive access” business model for textbooks and the place libraries are likely to play in facilitating the advance of that model.

Let’s examine the players as they walk onto the field. On the acquiring side we have the large entities that are the focus of so much attention here on the Scholarly Kitchen: Elsevier, Springer Nature, and their ilk. The targets are the Big Five of the textbook world: Pearson, McGraw-Hill Education, et al.

| Scholarly/research Publishers | College Textbook Publishers |

| Elsevier | Pearson |

| Springer Nature | McGraw-Hill Education |

| Wiley | Wiley |

| Informa/Taylor & Francis | Cengage |

| SAGE | Macmillan Publishers |

You can pad out the list of research publishers a bit — add Wolters Kluwer, for example, which is no stranger to mergers and acquisitions — but it would be a stretch because the strategic rationale is not in place, and you could even consider putting Oxford University Press and the American Chemical Society on the list, giving us some not-for-profit participants. But OUP, which is a billion-dollar company, is not structured to do mega-deals, and ACS would have to think hard about leveraging its balance sheet to swallow even the smallest of the college players (Macmillan). There is little room to add names on the textbook side, as the five listed here overwhelmingly dominate the U.S. market, with perhaps 85% of new book sales among them. It is noteworthy that only Wiley appears in both columns, which will invite bankers to pitch the company with a Hollywood-worthy PowerPoint deck, arguing in the morning that it should be a buyer, and in the evening that it should be a seller.

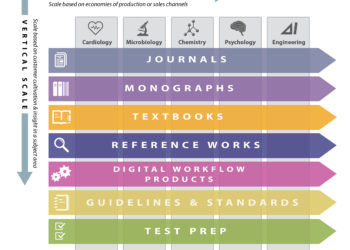

The investment thesis arises from the emergence of inclusive access (which I wrote about here) and the horizontal strategy, as my colleague Michael Clarke terms it, of the large research publishers. In inclusive access institutions take on some of the responsibility for provisioning textbooks for students, and the management of these arrangements increasingly lies with the library. This makes textbooks a new product category — in addition to journals, books, and databases — for publishers that mostly service libraries. In the horizontal strategy, which can only be played by the very largest publishers, the aim is to increase market share with libraries, to the detriment of the many smaller publishers who fight, with diminishing effect, for libraries’ attention. For Elsevier to acquire Cengage or McGraw-Hill, the rationale would simply be that this would further increase Elsevier’s leverage with libraries. And this in turn would lead small college publishers, just like small journal publishers before them, to seek the embrace of a major publisher, in order to maintain access to the marketplace.

If the name of the game is to have a dominant market share in academic libraries, why don’t the major STM publishers simply acquire more commercial journal publishers? They would if they could. The fact is that there are not many publishers left to buy; they have all pretty much been gobbled up already. The major publishers would also like to acquire the programs of society publishers, but for a number of reasons (which may be the subject of another post), societies resist the outright sale of their publications, choosing to license rights to a major partner for a limited period of time (typically 5-7 years) instead.

This is part of the reason that over the last few years mergers and acquisitions activity has moved from making deals for publishers to making deals for workflow and tools providers — because of the availability of commercial properties in this area (e.g., BEPress, Mendeley, colwiz, SSRN). Another rationale for these deals is that these workflow acquisitions typically open up a new revenue stream that does not derive from a library’s materials budget, thereby enabling growth in the academic sector without further straining library budgets. With inclusive access of college textbooks, research publishers add revenue that does not come out of the library’s budget (typically students pay for the texts when they sign up for a course), but is managed by the library: a perfect set of conditions for consolidation, market dominance, and eventual creeping price increases.

If one deal of this kind were to be consummated, we may see a domino effect. If Wiley moves first, Elsevier and Springer Nature may feel pressure (from Wall Street, if not from their own strategic outlook) to move in this direction, too. Whether a transaction of this kind will pay off is unknown, but the pressure to grow in a mature market makes management teams court big risks. There is, of course, nothing to stop the large college publishers from playing the role of the acquirer — some of these companies are very large — though the strategic reason for such a deal may not yet have arisen for them.

Of course, as big as a deal between, say, Taylor & Francis and Cengage may seem to those of us who toil in the tiny market for scholarly publishing, the upper bound of a deal, or a series of deals, could change drastically if a new category of buyer gets interested in this market. What if Microsoft decides to build out its Microsoft Academic experiment by acquiring T&F on Monday, Wiley on Tuesday, and Springer Nature on Wednesday? That’s lunch money for Microsoft. Or if IBM’s Watson develops an appetite for primary research? Down the hatch goes Elsevier’s unparalleled collection of full-text scientific articles. Heck, Watson is so smart that it could do the deal itself, without the help of bankers or even the approval of the IBM management. We should not assume that the scholarly publishing market as constituted today will be with us forever.

Discussion

7 Thoughts on "Consolidation in Academic Publishing Has a New Target"

Thanks for this piece Joe. I wonder if you see any role for Ebsco and ProQuest in this arena, given that their interests seem to focus a little more on the teaching and learning side of the library already? Perhaps they wouldn’t be seen to have access to the capital needed to make investments at this scale, but the strategic logic seems if anything stronger.

Good point, Roger. I think there is a case to be made for both ProQuest and EBSCO, and perhaps even for Gale, which is owned by Cengage, should Cengage wish to take the acquisition in the other direction. I am not sure about the strategic focus for PQ in this area, inasmuch as the company seems increasingly interested in tools and platforms over content. EBSCO is privately held, and the amount of debt (or dilution) the controlling family would have to take on may be an obstacle.

Textbooks these days may be more tools over content. Or, tools with content. Amazon buys Coursera is a prediction I’ve made for a long time. The most attractive acquisition is whichever company manages to get not only inclusive access contracts but which has a platform that captures OER.

Don’t hold you breath expecting Gale to buy anything, Cengage had an opportunity to buy several textbook companies in the fast few years and the venture folks supporting Cengage said a resounding no! Neither ProQuest nor EBSCO are likely to move into the textbook market. EBSCO is a well managed company and they seldom invest in declining markets nor do they take on corporate debt. There is nothing that the textbook market has to offer. The only community that has the money to chase this market is the venture community.

Over the last 10 years most of the college textbook publishers have been in play and none of the STM publishers have tried to tackle this market. While maybe not as bad as the newspaper market, the textbook publishers are a close second in having their market upended. Textbook sales are down and it is a very difficult market to be in these days. Students are buying less textbooks, there is pressure on lowering prices, and Amazon and others are in the used textbook market which significantly cuts into textbook sales. Springer and other publishers have conducted strategic reviews of their textbook business and monograph business with an eye to getting out of the textbook market.

Few STM publishing executives would want to tackle the textbook business as that ship has sailed. There are far better opportunities to invest.

I have a question that I am sure Joe will regard as uninformed or hopelessly naive. Exactly how is Elsevier (e.g.) a “scholarly” publisher? What is the scholarly institution whose mission is extended and fulfilled by Elsevier’s work? I understand how the University of California, or Princeton University, or MIT, or even the Rand Corporation are scholarly institutions that act as publishers. I equally understand how the American Historical Association, or the Modern Language Association, or the Massachusetts Medical Society, or the American Economic Association are scholarly institutions engaged in publishing. But how exactly is it that Elsevier, or Wiley, or Springer “scholarly”?

It seems to me considerable confusion arises from conflating institutions of higher education and learned societies with for-profit, publicly traded corporations that provide publishing services. That’s not to say there’s anything wrong with making a profit out of providing services (there isn’t), or that the providers of such services don’t offer important conveniences and efficiencies to both institutions and societies (they do). But they are only “scholarly” in the sense of the company they keep or the market they exploit, not the fundamental mission they have. They are not degree-granting institutions, they are not research institutions, and they are not associations for the advancement of any scholarly field. Why then speak of them as “scholarly”—and why regard them as somehow in the same category as the institutions and societies that are their clients? It’s more than a little like calling Wells Fargo a credit union because it provides retail banking services.

Wouldn’t it be that a publisher is a scholarly publisher because it … publishes scholarship?