It’s a standard practice in strategic planning to think long and hard about what competitors and other players in an industry segment may be planning to do. Thus it’s not hard to imagine the bigwigs at Elsevier sitting in a conference room where the topic is the latest move by John Wiley; and Wiley at the same time is contemplating the strategy of Springer Nature. This kind of speculation is not peculiar to the for-profit publishers. When the University of California Press launched two open access services, one for journals and one for monographs, surely that raised eyebrows at the presses at the University of Chicago and Johns Hopkins University. We would expect the AMA to keep an eye on the New England Journal of Medicine, one genetics journal to follow another genetics journal, and the American Chemical Society to plot out the possible future direction of the Royal Society of Chemistry. But what happens when the subject is Amazon, as mercurial and innovative as any company has ever been? How to get a handle on it? How to figure out its next move?

The fact is, we don’t know what the heck Amazon is now, even assuming we ever did. When it first appeared on the scene, it seemed clear that it was a new kind of bookstore. Think of Barnes & Noble, add the Internet, and you have Amazon, right? Well, not so fast. Even at the outset Amazon seemed to be playing a different game. I recall contemplating the Amazon affiliates program when the company first launched and not knowing just what to make of it. On one hand it seemed like the virtual equivalent of a chain bookstore, with many outlets being serviced by a small number of distribution centers; on the other hand, it seemed to be playing the game on a scale never before contemplated. The affiliates program had the potential to convert every Web site into a storefront for Amazon (you could never do anything remotely like this in bricks and mortar), and it also carried the implication that there would be one and only one bookstore on the Internet, a situation that is close to being the case today. So was Amazon a bookstore . . . or something else?

As Amazon grew it always seemed to fall into intelligible categories of business. From bookstores it branched into other kinds of ecommerce: music, video, electronics. It wasn’t a bookstore any more, but still it made a kind of sense: Amazon was evolving into a broad-based retailer, like Circuit City (remember them?) or Best Buy. But just as one made sense of that, Amazon was a step ahead, providing back-office services for other retailers (Toy ‘R’ Us and even Borders Books). Now, there is a way to make sense of that: Amazon was simply taking advantage of infrastructure it had already invested in. If it had learned how to provide secure credit card transactions online (a truly amazing bit of technology), it would simply make that capability available to others — for a fee, or course. At the same time it made it unnecessary for even its rivals, which were working in part on the Amazon platform, to make those investments themselves. Now what is the implication of that?

There have always been attempts, some of them partially convincing, to rationalize Amazon’s moves as “fitting in” to a broadly prepared plan. When Amazon began to sell used books, to the ongoing consternation of publishers, it “fit in” in that it was still about books. But look more closely and you see that the used book business is not textbook ecommerce (which, of course, Amazon pretty much invented) but more like a virtual marketplace, a variant on eBay, where Amazon simply matches buyers and sellers and never actually takes control of any of the products whose sale it facilitates.

The next hypothesis was that Amazon is all about the user data: like Google and Facebook, Amazon wants to know everything about you. Whereas Google and Facebook use this information to sell advertising, Amazon uses it to sell products. So in this sense even the brokerage of a used-book sale by a third party, or any transaction by the many retailers who have set up shop on the Amazon platform, adds to that database. No doubt end-user data collection is a big part of Amazon’s paradigm, but what are we to make then of AWS — Amazon Web Services — Amazon’s market-leading cloud-hosting business? AWS is a B2B operation; it does not collect user data. Now, how does that fit in?

I work closely with a software development company that uses AWS extensively. Their CEO told me that part of the reason AWS is so successful is that they make it so easy, as though they had gone through a round of negotiations with prospective clients and had ceded every deal point before being asked. Thus AWS is low-priced and only requires clients to pay for capacity it actually uses. (In contrast, think for a moment of all those books sitting in academic libraries that, literally, never circulate.) If a client experiences a sudden burst of activity — the effect of a news story, perhaps, or simply a favorable result from a marketing promotion — AWS simply, accordion-like, adds more capacity. While one could say that Amazon built AWS in order to take advantage of infrastructure it required for its own ecommerce operations, that does not account for the business model.

More recently Amazon has announced services in OER — Open Educational Resources — for the K-12 market and an innovative deal with New York City’s department of education. (Elizabeith Weise has a good summary of this deal on USA Today.) Once again these deals seem to fit in, but not quite. OER are by definition free: there is no ecommerce surrounding them, though a directory could be used to aggregate users, who in turn could be led to money-generating activities. This is the model Amazon uses for IMDB.com, an early acquisition, which is now an essential part of the online world for every movie and TV buff. The arrangement with the City of New York is about books, so it “fits,” but it also reveals a growing interest in institutional markets, which as every STM publisher knows, are worlds apart from the consumer markets where Amazon got its start.

Is there a central rationale for Amazon or is it simply a sprawling conglomerate, whose diversity is matched only by its opacity? It is not unusual to find such kitchen-sink companies among those that are privately held, where a founding entrepreneur and the family that inherits the assets keeps adding new activities to a single corporate umbrella, the better to challenge the tax man. But for a public company, Amazon must be said to be highly unusual in many ways.

I don’t myself see Amazon’s unity and have never been able to predict its next move. I don’t know what new market it has in its sights and sympathize with the CEOs of companies who may wake up one morning to find Amazon has changed all the rules. While it may be hard to predict Amazon’s strategic direction, however, once it enters a market Amazon typically behaves in similar ways, of which I will list three:

- Get in early. Amazon is obsessed with having a first-mover advantage. By getting in early, Amazon gets to define how the game is to be played. This leaves Amazon’s rivals to play catch-up.

- Build a moat around the business. Amazon makes it very hard for anyone to compete with it because of the protections it builds in, most often in the form of very low pricing. This is an unusual strategy, but it has worked brilliantly for Amazon. The online bookstore itself is the best example of this. Surely one would have expected to see a great number of online bookstores by now selling both print and digital titles. But why would anyone enter the market against a competitor whose pricing makes it hard to make money?

- Suppress innovation in others. Perhaps this is for a subsequent blog post, but Amazon’s willingness to makes its platforms available to third parties discourages others from building similar capabilities. This leaves Amazon as the leading innovator, absorbing both the risks and benefits of such a position.

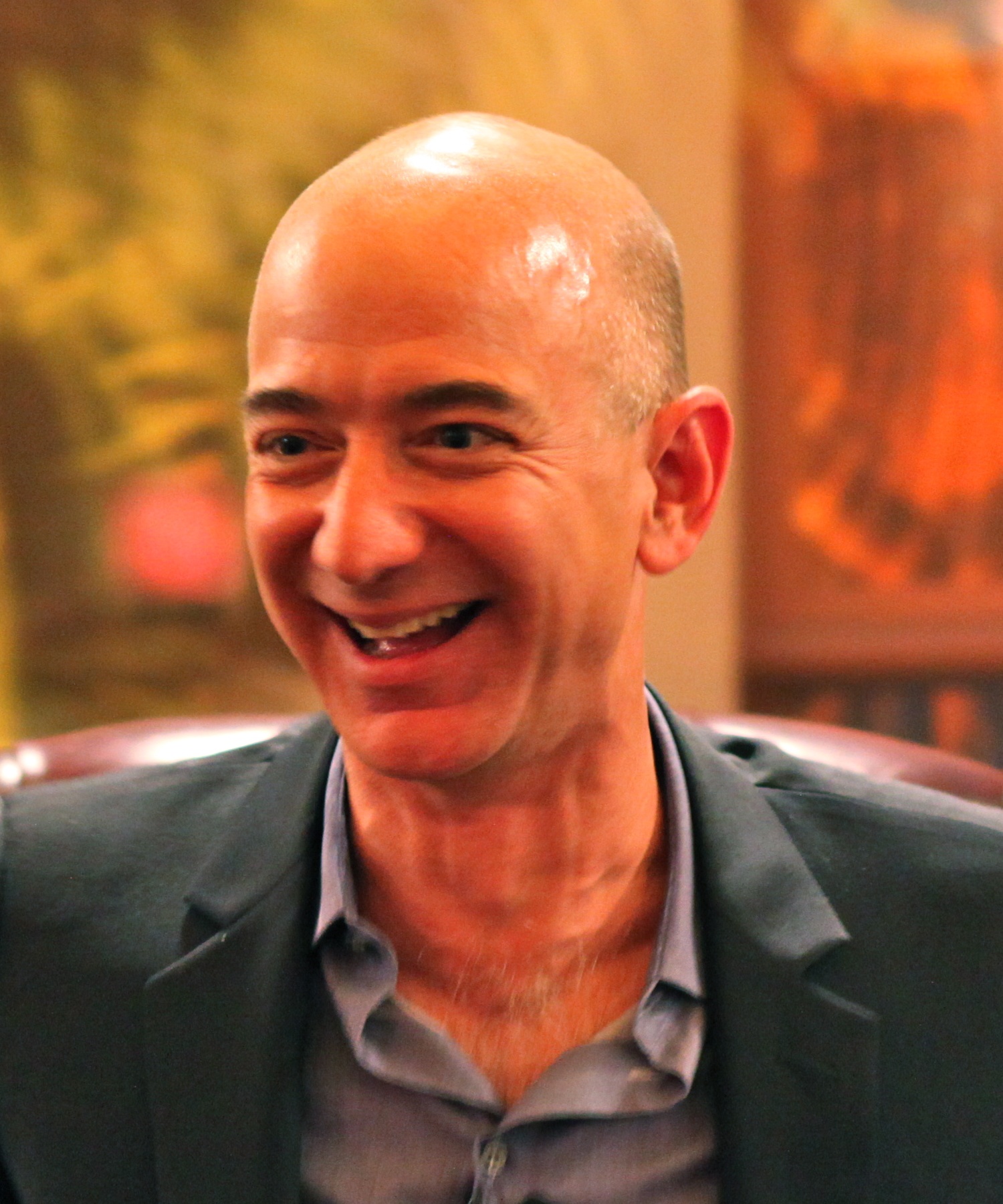

A very wealthy client of mine commented to me recently that Amazon is destroying capitalism. His point was that the company had not since its inception made any money and that its trading practices made it hard for anyone else to make money. I find it hard to find many similarities between Jeff Bezos and Bernie Sanders, but it does seem appropriate to ask where all this is going. Strategic planners who wrestle with the Amazon question in the meantime will have to determine how to compete with an organization that always seems to get there first and that makes it hard for anyone else to get a toehold.

But wait! Just when you thought it was safe to go back in the water, Amazon has reported enormous earnings. So what happened to the moat? Is Amazon now tempting others to enter their markets? This news broke after I wrote the first draft of this post. Once again Amazon has proved to be impossible to predict. It’s hard to know if the strong earnings will continue or are they perhaps simply a once-and-only-once signal to Wall Street to keep the stock price up? Meanwhile, it will be an uneasy night’s sleep for anyone who sees Amazon in the rear-view mirror.

Discussion

13 Thoughts on "What the Heck is Amazon up to Now?"

Don’t forget, Jeff Bezos (personally, not through Amazon) bought the Washington Post.

Amazon is an online realtor who happened to start with books. It is basically the same as Sears/Roebuck was from around the turn of the last century until about 1960, Sears’ first product was watches!

Bezos has created the largest on-line department store. Who knows he may become Elon Musk’s outlet for Tesla or be working on a deal with Apple to sell their cars.

But, the question is what difference does it make?

Either you want to compete in the on-line retail marketplace or not and if you do the question becomes can you sell on line better than Amazon and if not why not use them as your on-line distributor?

Amazon is far more than an online retailer, as I said in the post. Consider AWS, its fastest-growing unit. Find an equivalent at Sears of that.

One cannot find an equivalent at Sears because computing services at the time that Sears was dominant did not exist.

Amazon is now the world’s largest retailer surpassing Walmart.

AWS seems to be a derivative product from what they developed from their retail operations. Could be wrong, but that is what it seems to be to me.

Anyway, the gist of your argument is sound. Amazon is a fierce competitor in any market they enter and seem to expand products/services in the markets entered at a prodigious rate.

Lastly, I don’t think Amazon sits around and plans for what IBM, Microsoft, Apple or anyone else may do. I think they say, we are the competition let others worry about us. Their strategy seems to be lets build on our computing power.

AWS is a result of Amazon building infrastructure to support its operations. A lot of businesses do this, especially in new markets (online retail was still pretty new when Amazon started doing it). To their credit though, Amazon realized that they could transform this infrastructure investment into a product, and the result speaks for itself.

Joe is right, Amazon is not just a retailer, just like Google is not just a search company, and Apple is not just a computer company. The size of these firms enables them to experiment with new business models in the real world in real time, and not just conceptually, to see what succeeds and what doesn’t. It’s really quite fascinating to observe the evolution of these companies, and quite impossible to accurately predict what’s next for any of them.

To answer the question of what Amazon is up to, all businesses should assume that Amazon (or someone) will eventually rise up to challenge their current business model, because eventually, someone will, and we all need to be prepared for that. But that’s not a bad thing, as it ensures we’ll all keep innovating, which is the only way to stay relevant.

Totally agree on that. There is even a chance that this biz will equal or even be bigger than the retail. It is actually going to be the world’s data center –

Amazon Firing On All Cylinders As Cloud Computing Soars – http://renoun.io/discover/article/?article=572cb08ee5a7e9e00f000138&t=pages&q=amazon%20cloud&tp=7

Among the key behaviors should also be listed Amazon’s slash-and-burn, no-holds-barred tactics. The company forced the university press I once headed to use its POD vendor exclusively by threatening to de-list all of our books from its site if we did not go along with this demand.

Interestingly, after fighting for years against being taxed, Amazon has now started building huge warehouses all over the place, including several here in Texas, and it is even opening bricks-and-mortar bookstores. Of course it is also pioneering in the use of drones for speedy home delivery. And it is changing how its Prime customers can sign up, no longer insisting on an annual contract.

As a seller on Amazon I have seen it grow into this monster conglomerate in ways I couldn’t have foreseen. Its story is impressive to say the least and I look forward to see what else they come up with.

Since Amazon never made any profit selling books, it’s not really a bookstore, nor a retailer of other products.

The real customers are investors. The product Amazon sells is growth. The retail operation generates cash to finance expansion, which benefits investors. AWS changes this picture somewhat, however, by actually producing profits.

For Amazon all the stuff that people in publishing (or librarians like me) regard as valuable is just collateral. The initial entry into bookselling was financed by stock sales during the tech bubble, enabling Amazon to lose money on nearly every sale and yet remain in business.

This is analogous with the way that Google’s product is eyeballs or interactions, which it sells to advertisers. Google is not selling its search service, so that isn’t its product.